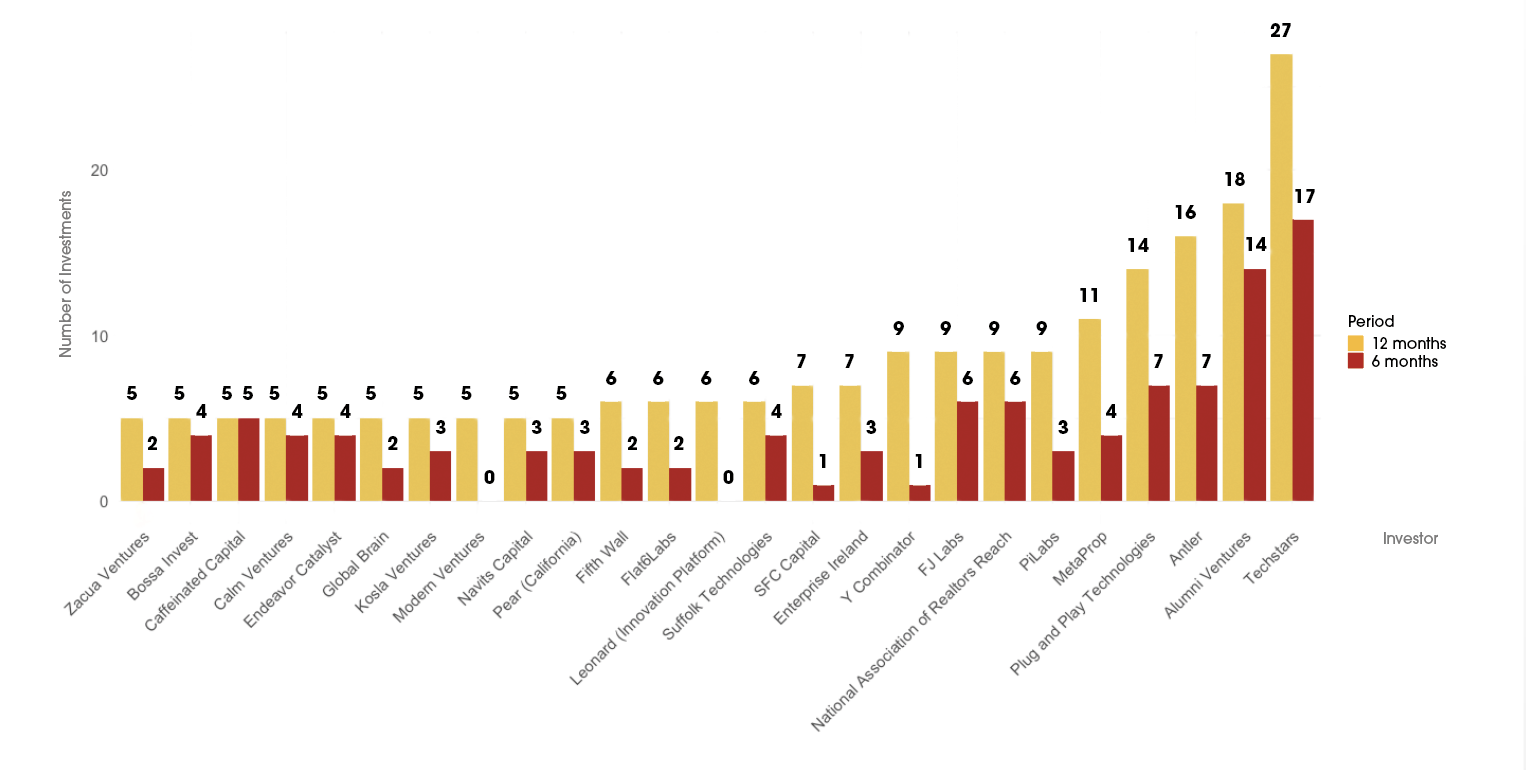

Figure 12: Top 10 Global investors with an office in Europe by last investment type, 2023-2024 FY

Figure 12 shows the top global investors with an office in Europe for the 2023 – 2024 fiscal year, as measured by their total number of investments. The data is a reminder that it may not necessarily be a European investor that could be involved in some of the biggest and most innovative PropTech plays in the European market. Instead, we have a number of American accelerators that have a significant foothold in Europe, including the giants: Y Combinator, Plug & Play Technologies, and TechStars. These three top players represent the earliest, most active, and most impactful accelerators in the market. Y Combinator, for instance, helped to launch globally renowned companies, such as AirBnb, DoorDash and Coinbase. Plug and Play has raised over $9 billion for its portfolio, boast over 300 VC investors in its ecosystem. Finally, Techstars continues to back some of the freshest and most innovative entrepreneurs on the market, including the leaders of Craftle and Raise Robotics, who feature in the interviews of this year’s barometer. At the same time, these giants are also involved in a variety of investment types. For instance, while BPI France and Y Combinator were recently involved in Later Stage VC deals and Plug and Play was involved in an Early-Stage VC deal, Techstars was involved in a seed round.

Figure 13: Top 10 Deals, 2023-2024 FY

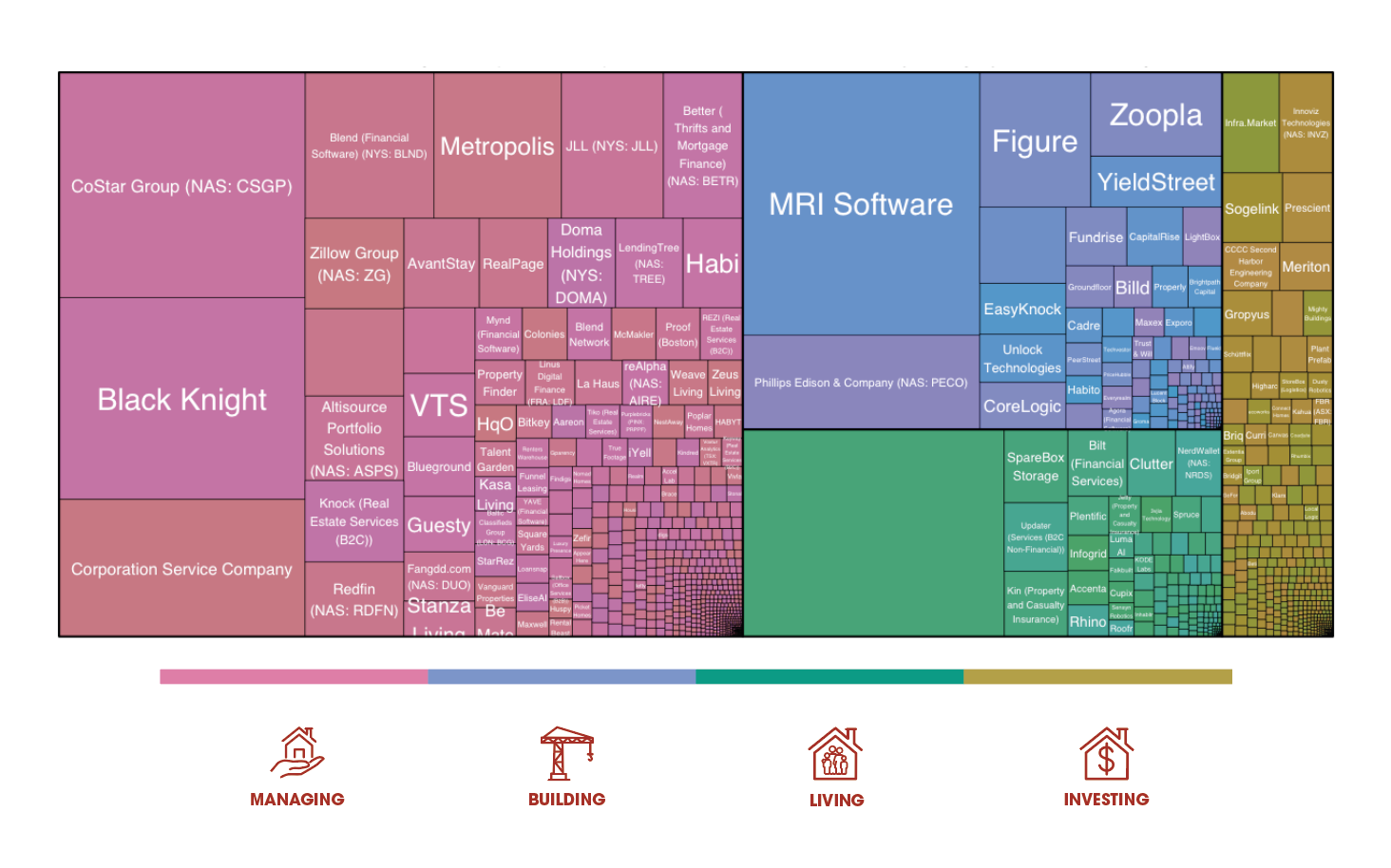

Figure 13 shows the largest deals of the 2023 – 2024 fiscal year. We reported the Intercontinental Exchange (ICE) acquisition in the 2023 Barometer, as the deal was announced already with a plan of merger in May 2022. Black Knight is primarily a data analytics and software company operating to serve the housing finance industry, especially mortgage lending and servicing, but also secondary markets. Thus, the key technology at play could be argued to be Black Knight’s data analytics. However, negotiations that took nearly a year resulted in an amended merger agreement as of March 2023. Shares were then rolled over in August 2023 and the deadline for Black Knight shareholders to submit elections was September 1. Thus, the deal was only finally completed on September 5, 2023, making it the top deal to be completed during the 2023-2024 fiscal year.

Figure 14: PropTech Deals, 2023-2024, by Company Category

Figure 14 gives an overall portrayal of the deals in the PropTech ecosystem over the course of the past fiscal year. As we have indicated above, the performance of the Managing category is now more than half of the market share in terms of funds raised in a single fiscal year. While the long-term fundraising totals, as previously indicated, are much more balanced, the deals completed in the past year were overwhelmingly dominated by Managing category companies. This does not simply include the top six deals in the category, all of which were more than a billion USD each, but it also includes over 150 small deals that were less than a million USD each. The nearest competitor in terms of small deals under a million USD was the Building category, with 106 deals. The reason the numbers of these small deals are significant is because they typically represent the very early initial seed funds of small startups.

A category that is seeding more startups now will almost certainly see a larger share of the market in the future. There is simply more action in the Managing category and it’s worth keeping that dynamic in mind as we consider our global PropTech Update of the past two decades of the industry in Chapter 3.