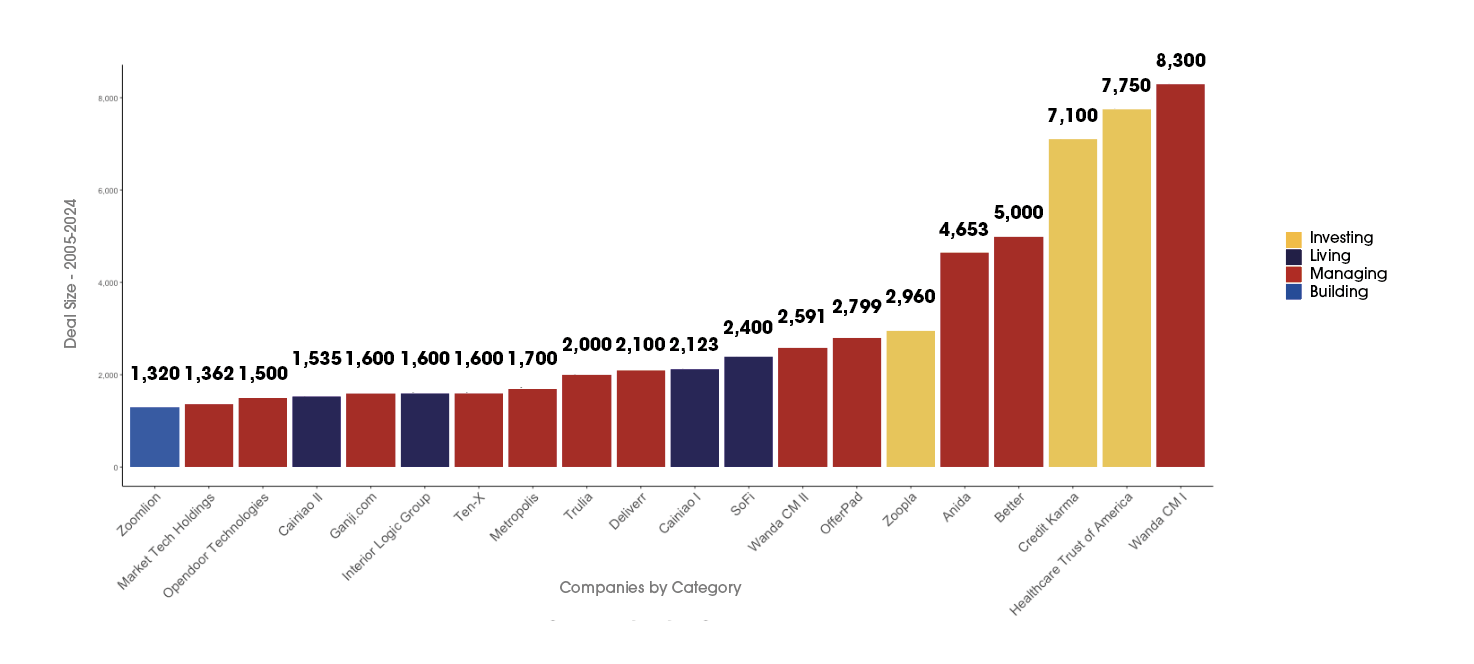

While the Top 10 deals in the past decade look relatively mixed, if we broaden the scope to the Top 20 deals, as illustrated by Figure 16, we can see a distinct trend emerge: more than half of the money being raised in these major deals is being generated for the Managing category of companies. In part, this is likely because not all the managing deals have their value more closely tied to the value of the assets that they manage, and therefore are more consistently able to achieve greater valuations. At the same time, there is incredible technological innovation in the Building category of companies, but we just don’t see the technological innovation and patents themselves as major disruptors, somewhat surprisingly. Indeed, the only Building company on the Top 20 list is Zoomlion Intelligent Aerial Work, a company that has developed an enormous fleet of smart construction equipment. Intelligent construction equipment, such as Zoomlion’s products typically offer a combination of contemporary scientific advancements in robotics, sensors, and controllers, as well as software solutions that combine the use of Big Data analytics and AI, along with other technologies, to improve the efficiency and the vital safety features of equipment. The combination of these technologies allows intelligent construction equipment to collect, store, analyze, and process information, while also executing appropriate actions and engaging in rapid decision-making facilitated by the operator.

Zoomlion Intelligent Aerial Work was acquired by Roadrover – which is primarily a provider of automotive electronic solutions, including in navigation and audio systems, smart seating systems and more – through a $1.32 Billion USD (CNY 9.42 Billion) LBO on February 23, 2024. Although the reasoning for the deal may appear opaque at first glance, a closer read reveals that Roadrover is in turn predominantly owned by the plural majority shareholder, Zoomlion Heavy Industry Science, the original parent company of Zoomlion Intelligent Aerial Work. Additionally, since Zoomlion Intelligent Aerial Work was previously held by several outside investors, the deal represents a significant assessment by the parent company that it’s PropTech investment is indeed bearing enough fruit – quite literally, in the case of annual revenues – that they believe these revenues can be large enough to service the debt taken by Roadrover through the buyout package. In other words, they represent an assessment by the parent company, Zoomlion Heavy Industry Science, that their intelligent building equipment can transform portfolios, in addition to the marketplace.