Asia

The dynamics of the ProPTech ecosystem in Asia are similar in several ways, when compared to several other markets. For instance, when we look at assets under management (AUM), sovereign wealth funds hold the largest slots, like in France, where BpiFrance reigns supreme. However, when we examine dry powder resources, venture firms emerge at the head of the pack, much like the American market. In the past, Israel and other markets, such as Turkey and Iran, or countries in the Arabian Peninsula, showed significant activity. However, few deals were completed in Western Asia this year. The situation contrasts with the activity further eastward.

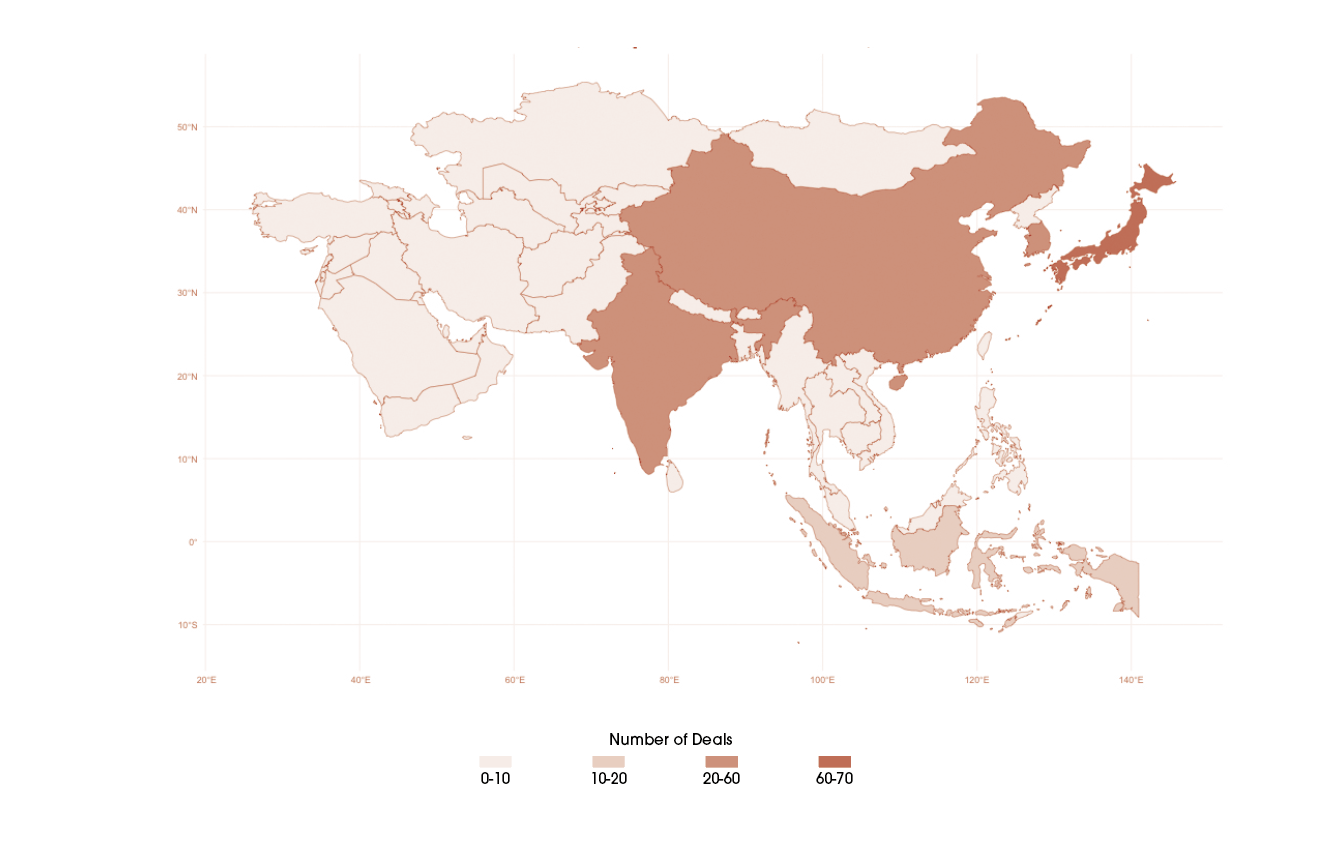

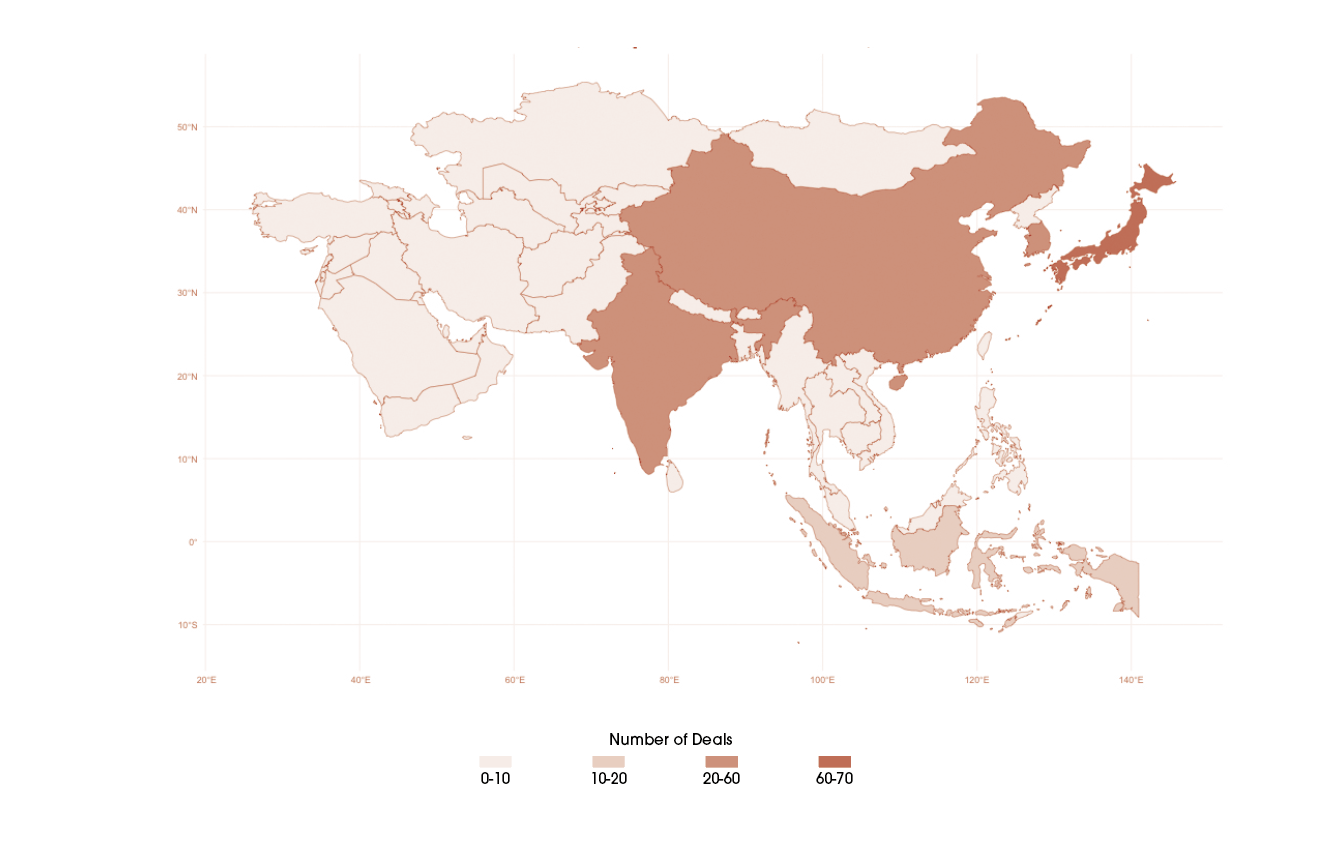

Figure 34: Raw Deal Count, PropTech Deals in Asia, 2023-2024 FY

Figure 34 shows the raw deal count of PropTech deals in Asia in the 2023-2024 fiscal year. Japan (65), India (60), South Korea (51) and China (51) were virtually balanced in the number of deals completed in the past year, while Singapore (21), and Indonesia (13) came in fifth and sixth. The Philippines (7), Malaysia (6), Hong Kong (6), Vietnam (5), and Bangladesh (4) made up a second tier of active markets, while Pakistan (2), Thailand (2), Azerbaijan (1), and Kazakhstan (1) made up a third tier. However, the largest investors who are breaking into the PropTech space, as measured by assets under management are not in Japan, China, or South Korea, as one might expect, but actually in Singapore, Southeast Asia’s gateway between the South China Sea in the East and the India Ocean to the west.

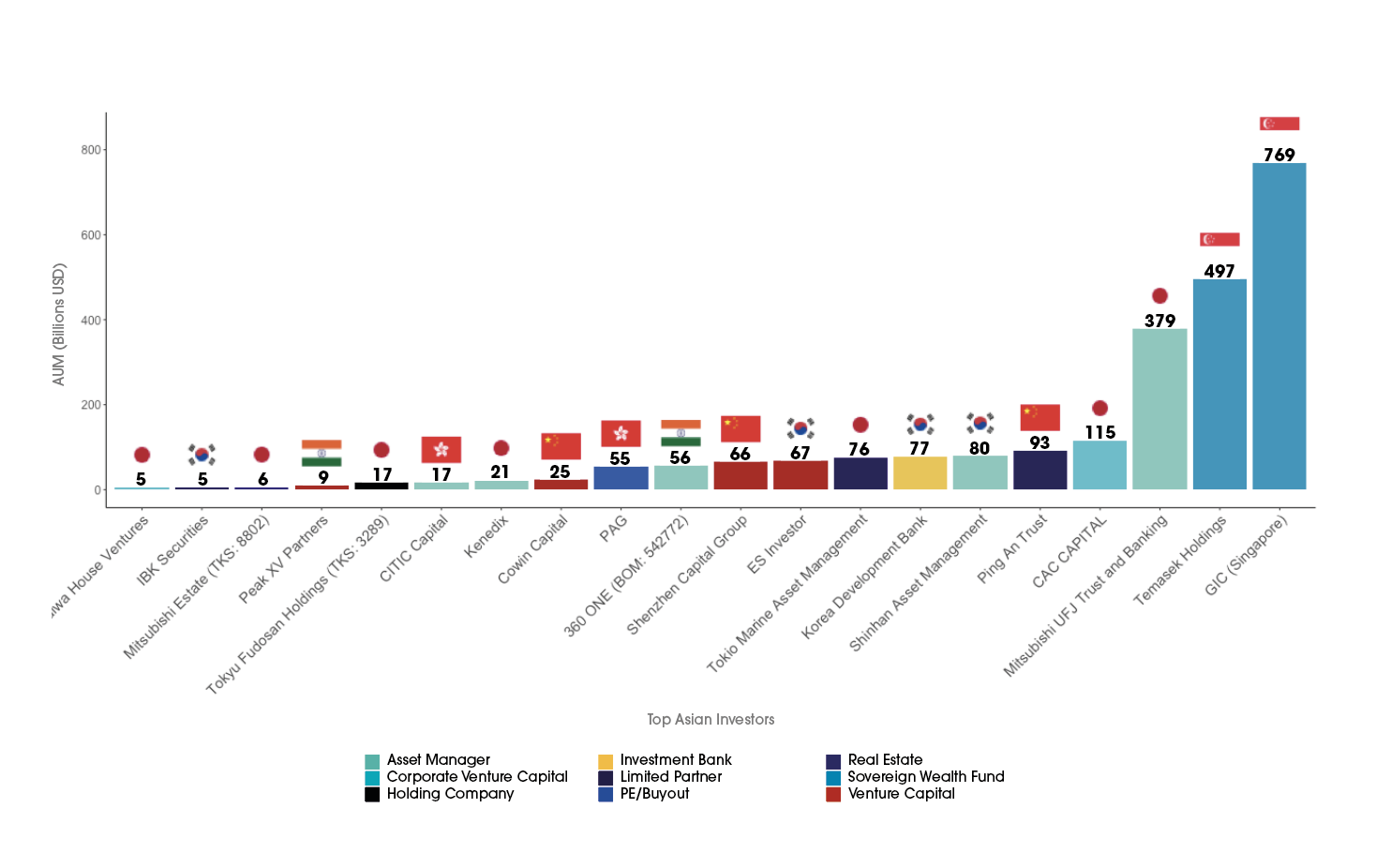

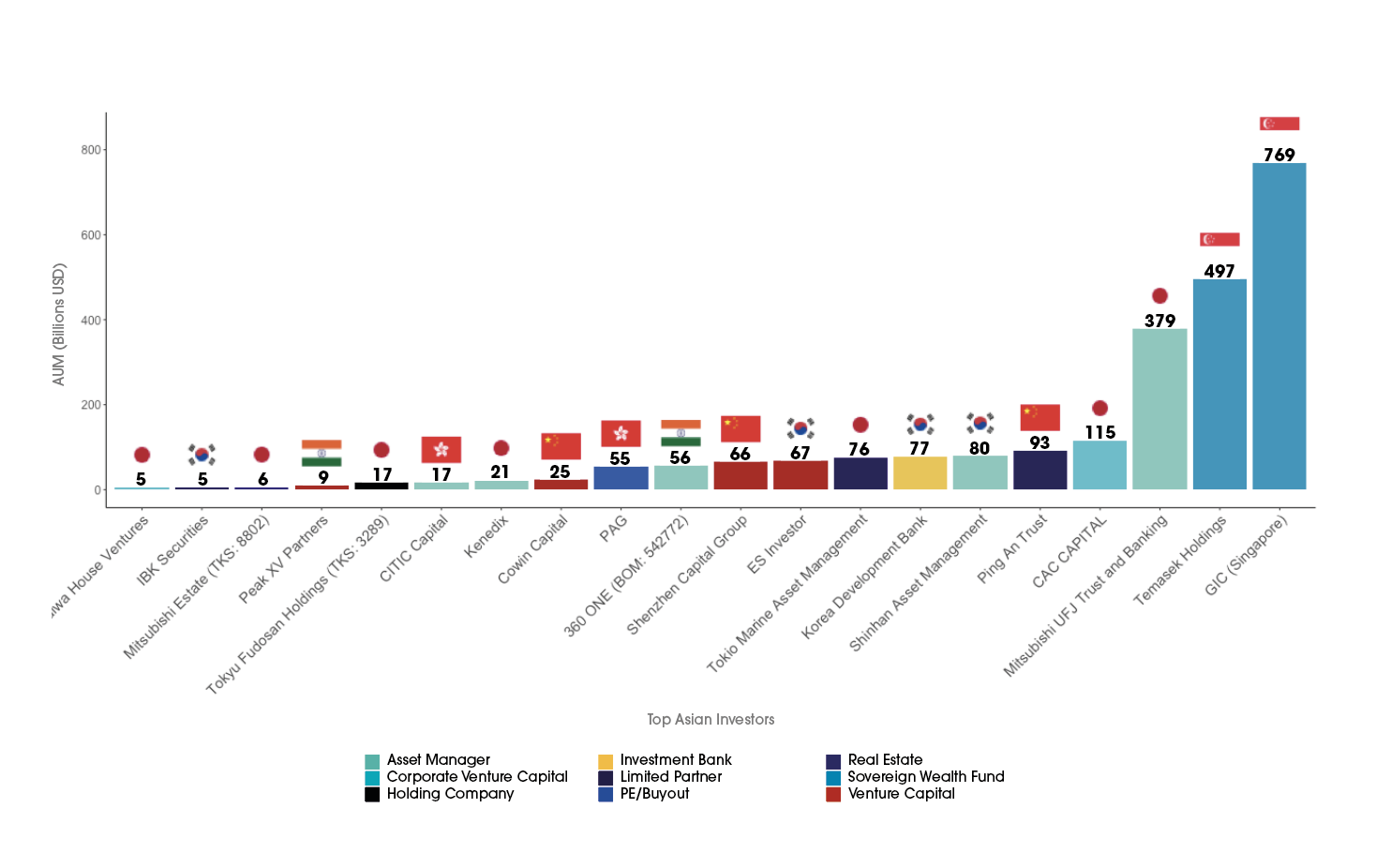

Figure 35: Top 20 Investors in Asia by Type, HQ Location, and Assets Under Management, 2023-2024 FY

Figure 35 shows the top 20 investors in Asia by their type, location, and AUM for the 2023-2024 fiscal year. The top two investors by AUM are Sovereign Wealth Funds (GIC, Singapore and Temasek Holdings) located in Singapore. The next two spots are held by an asset manager (Mitsubishi UFJ Trust and Banking) and a corporate venture capital firm (CAC Capital), both located in Japan. The limited partner, Ping An Trust of China – an insurance firm – took the number five spot, while the next two spots were taken by two South Korean firms, Shinhan Asset Management (an asset manager firm), and Korea Development Bank (an investment bank). While Tokio Marine Asset Management (a limited partnership headquartered in Japan) took the number eight spot, two venture capital firms rounded out the top ten, one from South Korea (ES Investor) and one from China (Shenzhen Capital Group). However, when we shift our lenses to examine dry powder, venture capital plays an even more significant role.

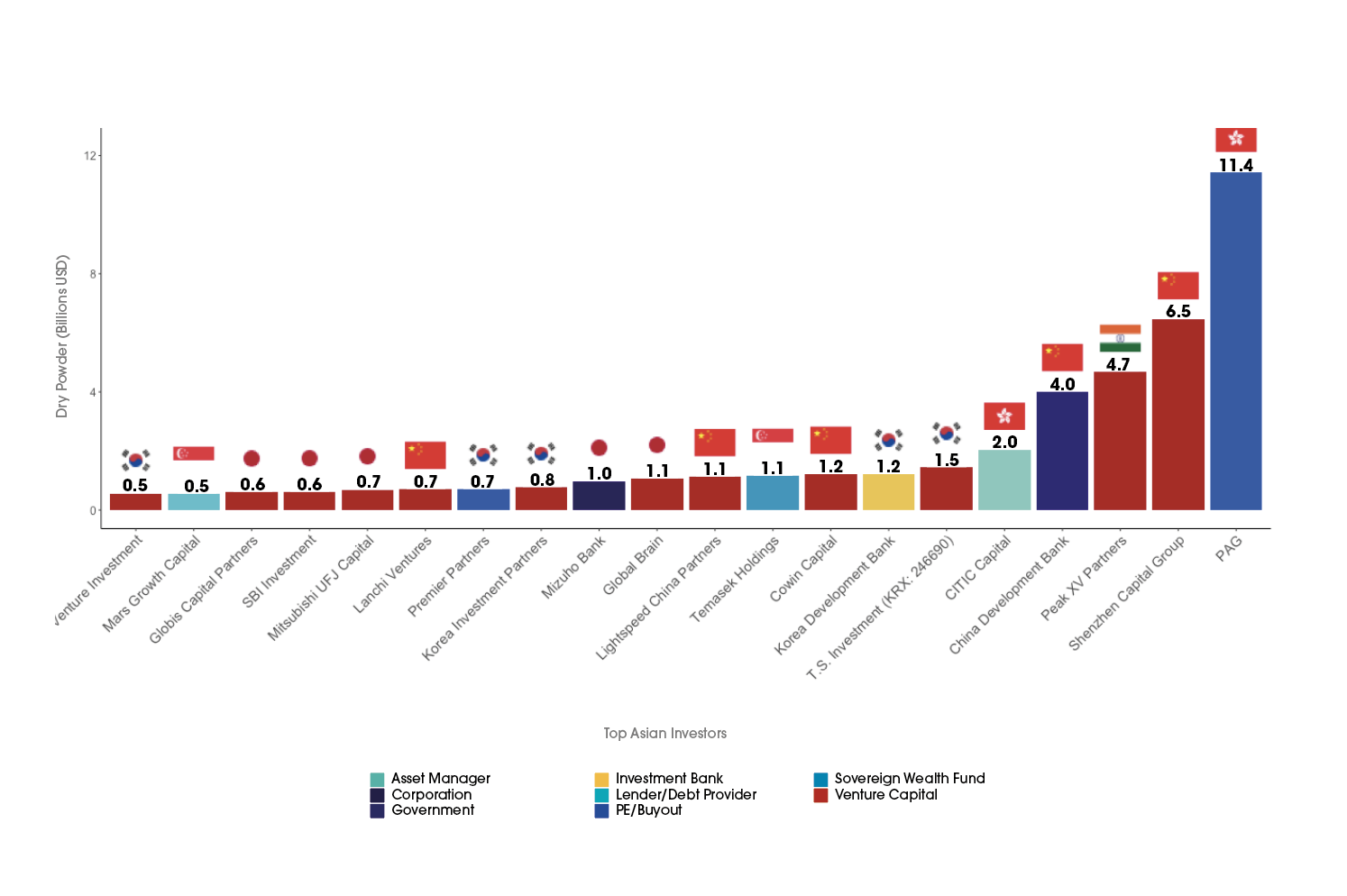

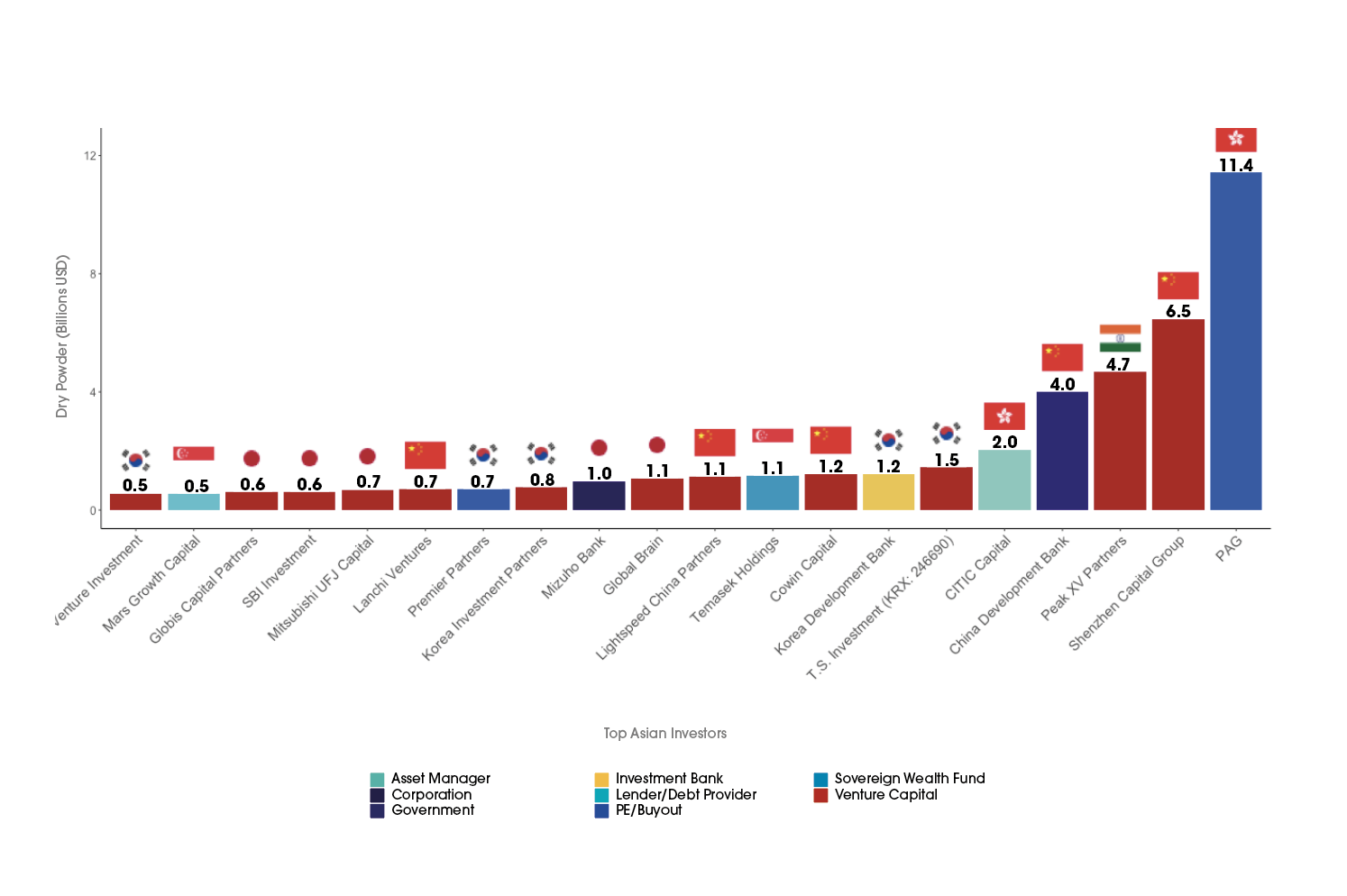

Figure 36: Top 20 Investors in Asia by Type, HQ Location, and Dry Powder, 2023-2024 FY

Figure 36 shows the top 20 investors in Asia by type, location, and their dry powder. As we can see, Venture Capital firms make up twelve of the top 20 slots, just as they did in Germany. However, it is also the case that when we compare to the European region, said firms are rather dispersed by their country of headquarters location. Yet, in Europe we would expect all the top investors to essentially be in the United Kingdom, and we know that the capitalization of the market in the Asia Pacific is much more broadly dispersed. For instance, while the top Venture players by Dry powder, being Shenzhen Capital Group (China) and Peak XV Partners (formerly Sequoia Capital India and SEA) are located in the largest countries by population in the region, most of the rest are evenly distributed between South Korea, China, and Japan.

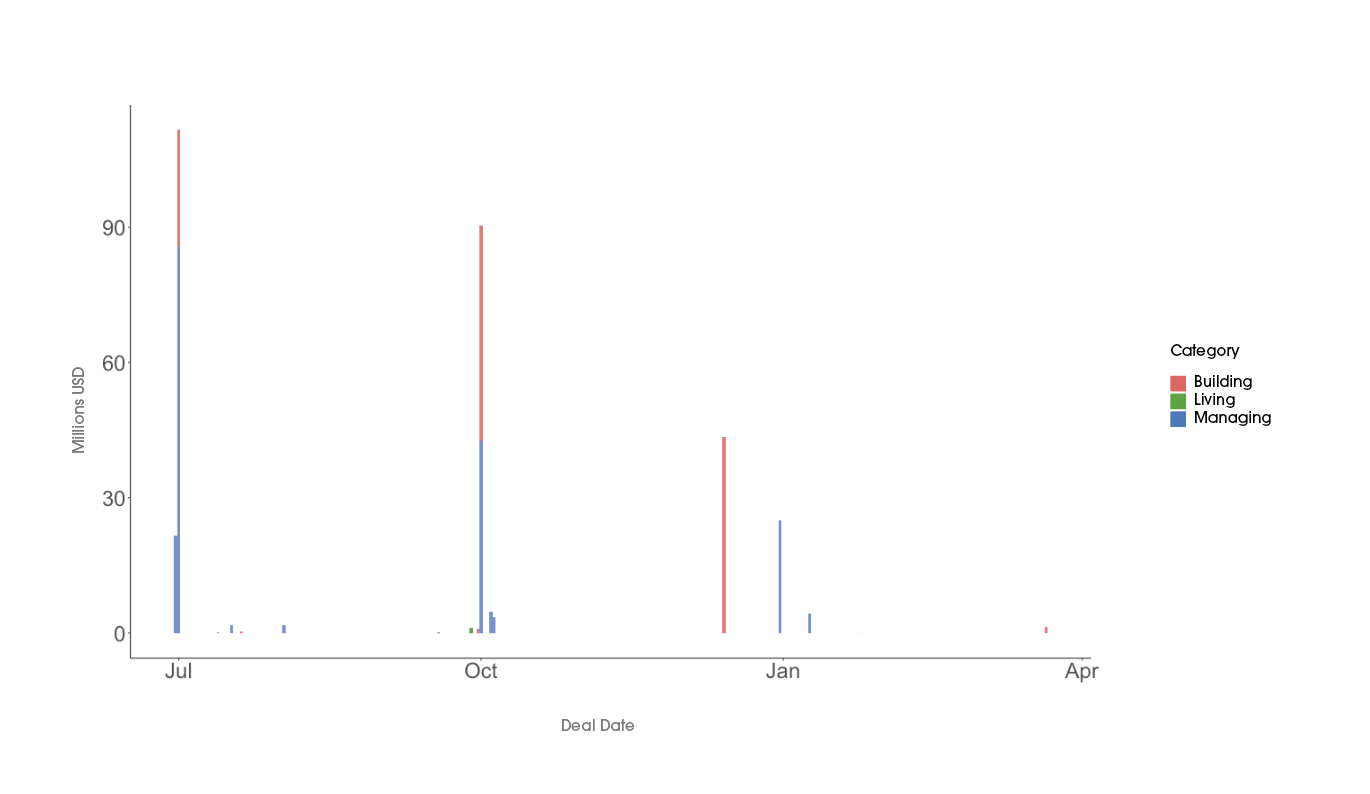

Figure 37: Top Ten PropTech Deals in Asia by Country & Category, 2023-2024 FY

Figure 37 shows the top ten PropTech deals in Asia by country, category, and amount for the 2023-2024 fiscal year. The largest deals were in China, including the Wanda Commercial Management deal and the Zoomlion deal. After Zoomlion and Wanda Commercial Management, the largest deals in Asia during the 2023-2024 fiscal year was completed by Infra Market. Infra Market is a developer of a massive, efficient, online procurement marketplace designed to serve the real estate and building materials industries. Their centralized platform aggregates client demands, connecting them with their supply chain, while creating affordable credit options, and establishing efficient logistics for delivery and tracking. They have established a presence in 22 of 28 states in India, have more than 100 dedicated manufacturing units and operate more than four thousand individual retail locations, along with more than 25 exclusive brand outlets. They are transforming the ecosystem by leveraging technology and scaling innovation. Additionally, they operate the country’s only ISO-certified world-class R&D center. Infra Market completed three deals during the year, including an undisclosed amount of debt financing in September, with details of that deal yet to be released. However, they also completed a deal raising $150 million USD of debt financing earlier in the fiscal year and even more recently, they raised a rather significant $50 million in venture funding from LIQUiDITY Group – the world’s leading AI-driven direct lender – and Mars Growth Capital – the Singapore-based investment firm that focuses on debt and growth equity in Europe and the Asia-Pacific – on May 28th, 2024, putting their pre-money valuation at $2.55 billion USD.