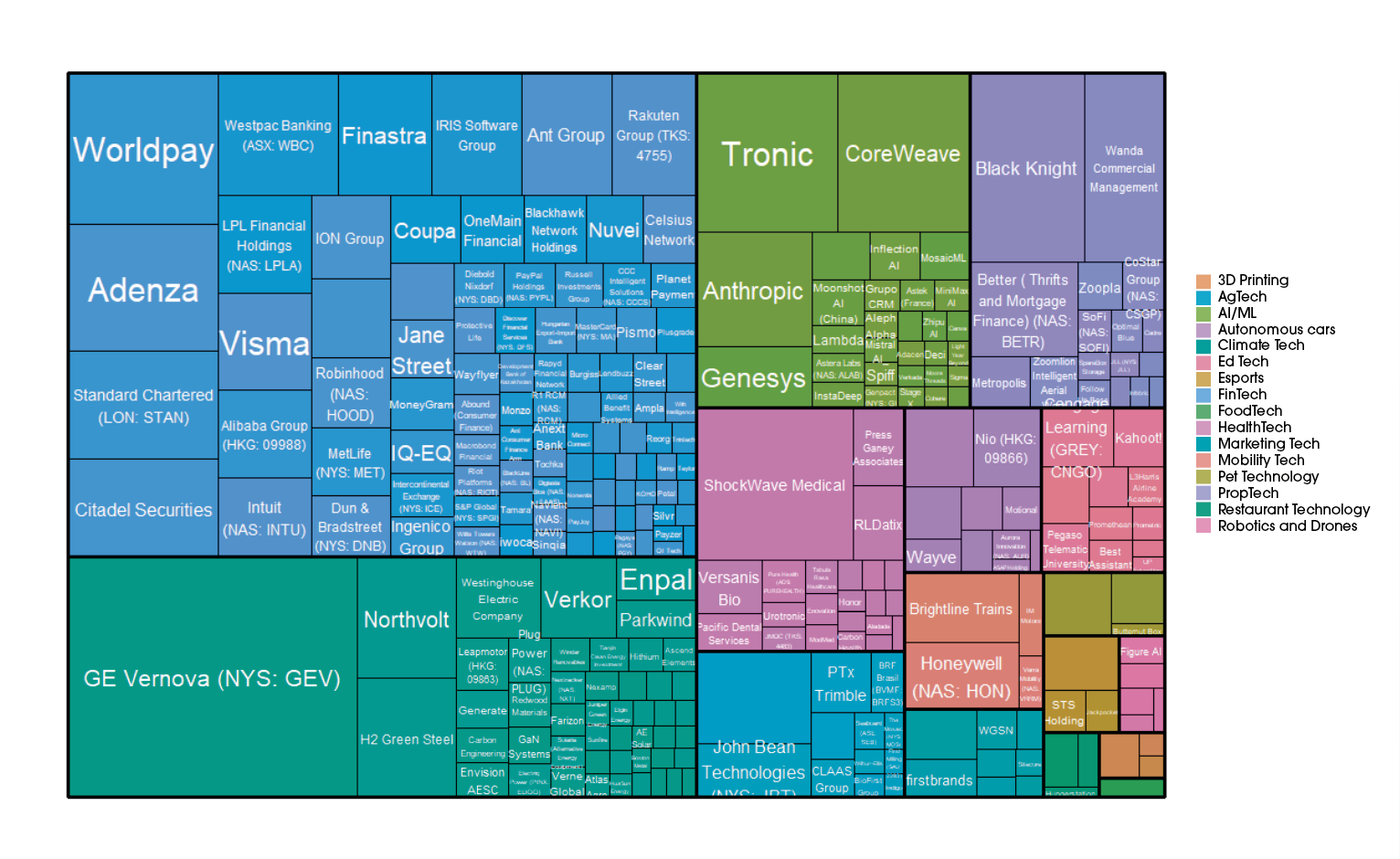

In the HealthTech industry, the top player of the cycle was ShockWave Medical, a medical device company. ShockWave Medical especially focuses on the development and commercialization of novel technologies to improve the care and treatment of patients with cardiovascular diseases, by making use of sonic pressure waves. This IVL (intravascular lithotripsy) technology minimizes the invasiveness of surgery, is easier for providers to use, and thus improves outcomes for patients with certain types of cardiovascular diseases. Not surprisingly, the company’s technology has been highlight celebrated and the company was acquired by Johnson and Johnson for $13.1 billion USD on May 31, 2024, on the final day of the 2023-2024 fiscal year. The acquisition signifies a shift among Johnson and Johnson’s leadership, as well as among other leaders in the healthcare industry, back toward research and development of core technologies improving patient outcomes for common diseases in the wake of the global pandemic. Now that investment in vaccines has declined, industry leaders are looking ever more toward technological solutions for the future to treat other major problems for society.

The number three slot in the top deals among competing industries in the past year was taken by a FinTech company, Worldpay. Worldpay is an operator of an electronic payment and banking platform that is intended to deliver one-stop-shop payments. Worldpay offers debit and credit card processing, cloud based payment solutions, mail payments, phone payments, card machine payments, and POS payments through a unified platform. Thus, they are providing a technological solution to integrate the past worlds of phone and mail payments, which are still quite commonly used, with the contemporary world of cloud-based payment solutions. Thus, the private equity company GTCR saw the promise in Worldpay’s technology and acquired the company through a $12.50 billion USD leveraged buyout offer (LBO) deal on February 1, 2024. The deal resulted in a $18.5 billion USD valuation for Worldpay, which had also raised $62 million of debt refinancing in September of 2023.

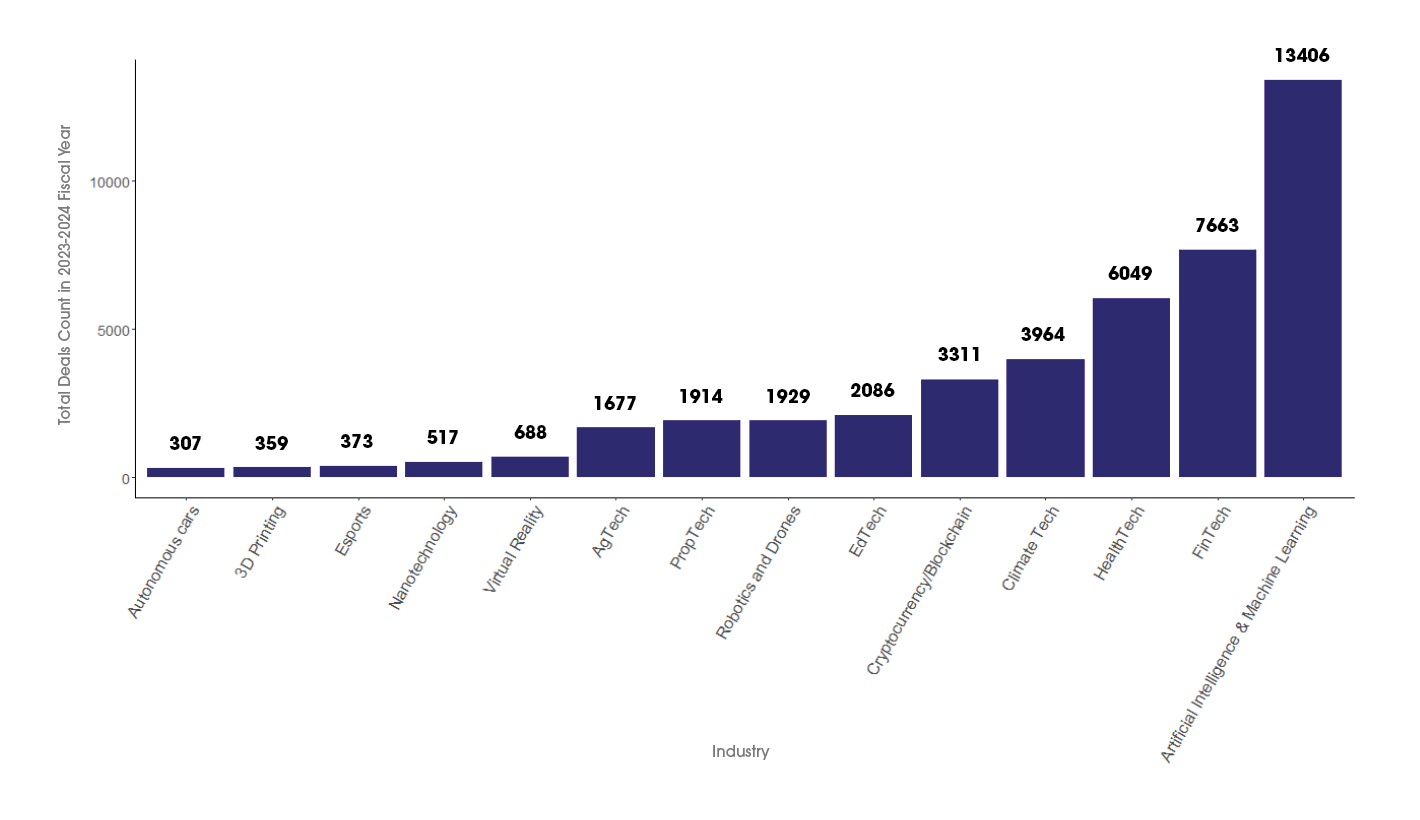

While it is surprising to see that Climate Tech took the top place among competing industries, it is also notable that four of the top ten deals were in the FinTech industry, including Worldpay, Adenza ($10.5 billion), Finastra ($6.3 billion) and Ant Group ($5.98 billion). Much of the market map is comparable to the previous fiscal year, with one notable change: AI/ML has begun to take up a larger share of the market, with the HealthTech industry, surprisingly, taking up a smaller share. Also notable is that the FinTech industry deals remained as a quite substantial portion of the market, given the nature of market pressures which might have led some investors to assume that they would perform less strongly when compared to the previous fiscal cycle. However, investor confidence has remained relatively strong, despite interest rates remaining high and borrowing remaining strained. The evidence suggests the FinTech industry may indeed be more resilient than previously hypothesized.