PropTech isn’t just an addition to the real estate industry—it’s a catalyst transforming every corner of the sector, from construction sites to investment platforms. With real estate valued globally at over $634.90 trillion USD and the European real estate market alone projected to reach $174.5 trillion USD by the end of 2024, the stakes are immense.

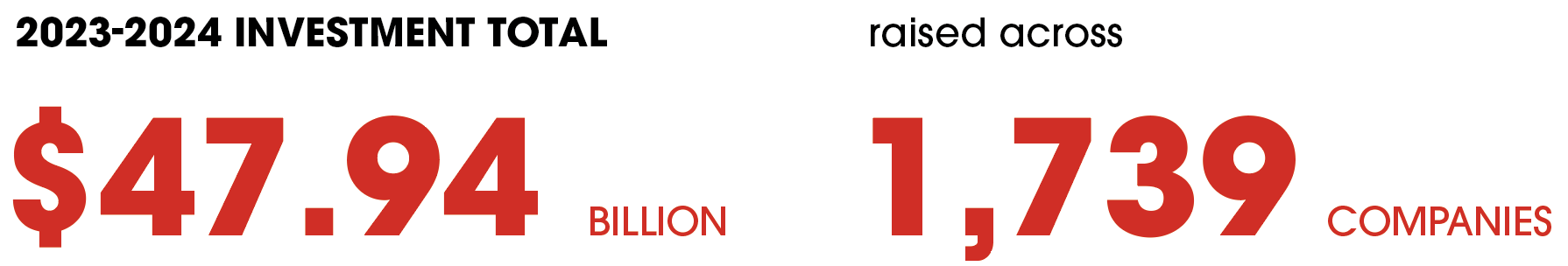

PropTech’s influence extends across the entire property lifecycle, making processes more efficient, secure, and data driven. Take the 13.78% increase in PropTech investments this past fiscal year, for example; it not only signals growth but highlights a sector advancing at a pace that’s outstripping traditional growth rates in the American and Eurozone economies.

Further, we see these impacts in the way technology is shaping property management—a category that has generated $44.7 billion in revenue from $40 billion in cumulative investment. These figures underscore how management technologies, from tenant tools to data-driven decision platforms, are adding direct financial value while improving user experiences.

Similarly, the Building category, despite traditionally lower investment, is proving to be a high-return area, generating $21.2 billion USD in revenue from just $6.5 billion in investment. This points to a pent-up demand for innovative building solutions that could drastically enhance both safety and efficiency. The rise of robotics and AI-driven equipment in construction is just one example of how PropTech is closing gaps and creating new standards in construction efficiency and worker safety.

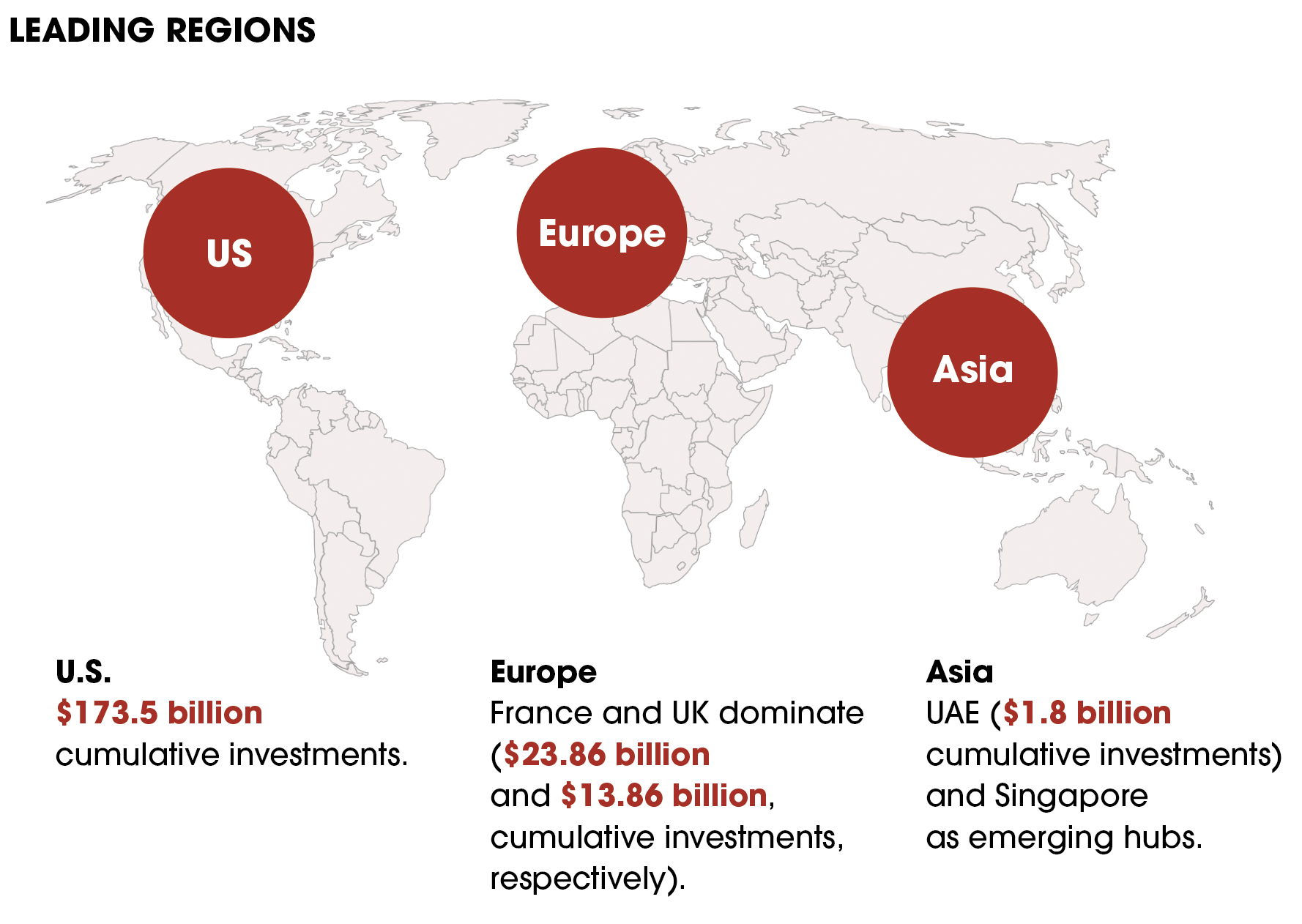

Globally, PropTech’s reach is also reshaping investment flows and regional opportunities. While U.S.-based PropTech companies raised $173.5 billion USD this past year, the UK, France, and Germany are emerging as central hubs in Europe, with Asia-Pacific countries like Japan, Singapore, and the UAE also establishing strong footholds. Even smaller markets, from Brazil’s $2.5 billion USD in PropTech investments to Vietnam, Kenya, and the Philippines are becoming focal points for the next generation of property innovations.

In short, PropTech’s impact is widespread and accelerating, driven by significant capital inflows, innovative technologies, and the ability to solve real-world problems in the property industry. These advancements are paving the way for a more integrated, responsive, and high-performing real estate sector, transforming not only how properties are built, bought, managed, and lived in but also creating a ripple effect throughout our economies and communities.