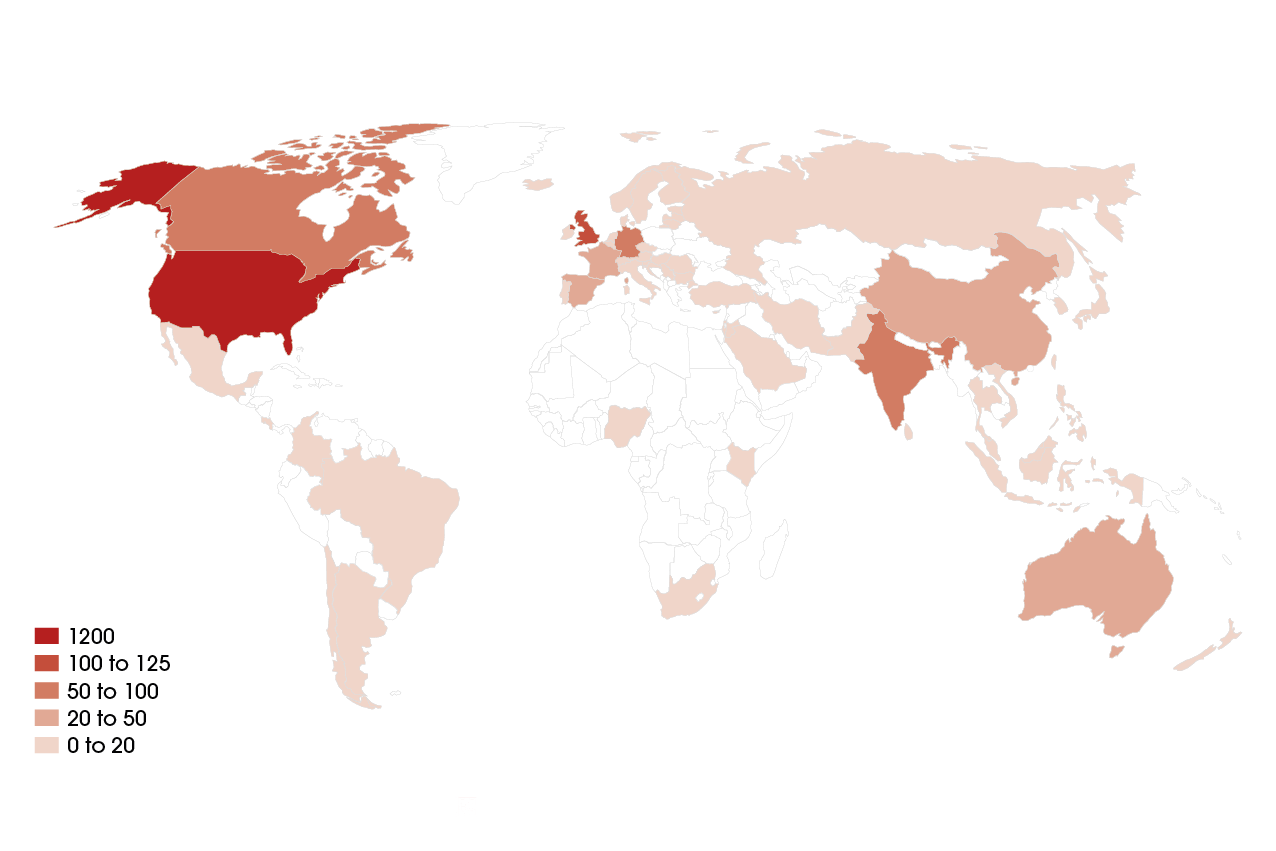

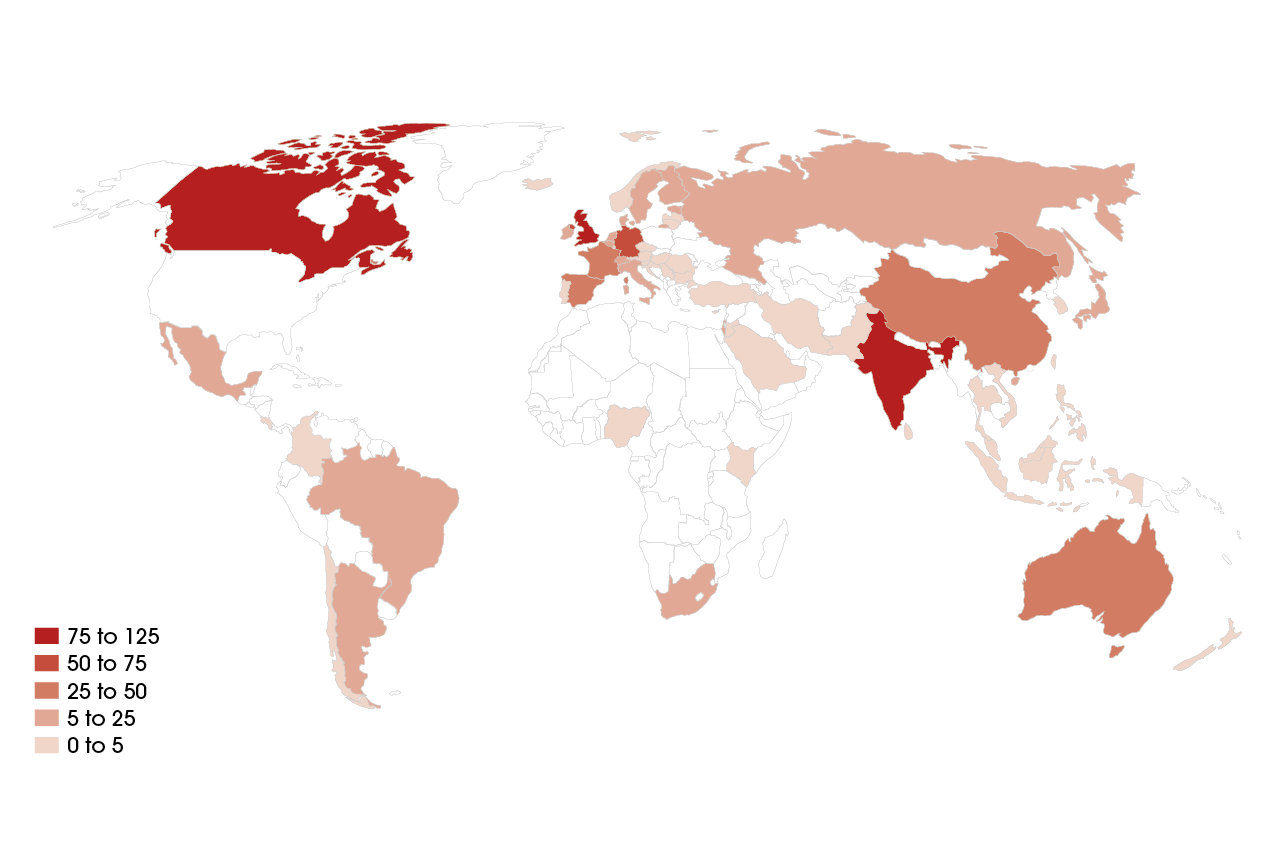

According to Figure 15, which shows the global distribution of PropTech companies, the United States is leading the change with most companies. The gap to the rest of the world is significant, with more than a thousand companies differentiating the United States from the next competing countries. The next most significant market is the United Kingdom. However, if we remove the United States from consideration, some interesting trends emerge.

- Accueil

- Évaluer sa maturité numérique

- Plus de 100 Professionnels du Numérique pour vous accompagner.

- Programme de sensibilisation

- FlashUP – Tool Box

- Financer son projet

- Tout savoir sur le programme EME !

- Comprendre le numérique

- PropTech Global Trends 2024

- Référencement Annuaire Professionnels du Numérique

- Guide du E-Commerce

- Témoignages EME

- F.A.Q.

- Contact