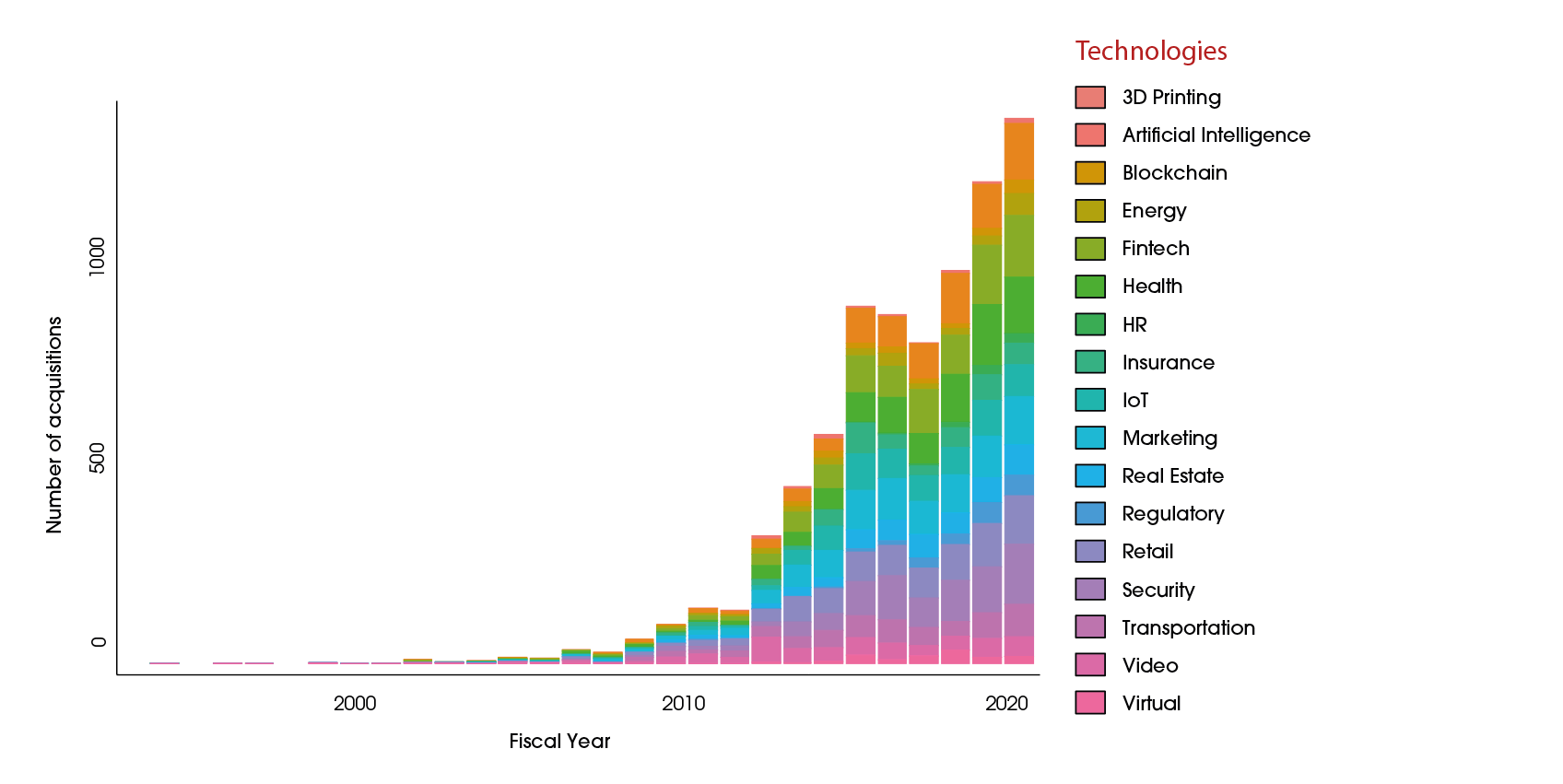

Figure 31 also gives us a raw comparison of acquisitions by sector of the economy, so that we can see the nature of acquisitions in competing sectors side-by-side with the Real Estate market. What we are seeing is that the number of acquisitions, and therefore the market consolidation, in Security, Retail, Health, FinTech, and Artificial Intelligence are all significantly increasing trends. Around 2010, only Security was showing the beginning of this trend of growth in acquisitions. Around 2015, we saw major increases in the raw numbers of acquisitions in Health, Retail, and FinTech. Although acquisitions in Real Estate and Artificial Intelligence did grow, we don’t see major growth in acquisitions among these sectors until 2016 through 2020. That said, the acquisitions in Artificial Intelligence have shot upward in the past few fiscal years, and Real Estate has still not consolidated by the same amount.

What Figure 31 means for us, is that we can predict Real Estate will significantly increase in the number of acquisitions in the coming year, following market trends, even if still a bit behind these other key sectors, including even smaller sectors, such as Blockchain, Video, Regulatory, and 3D Printing.