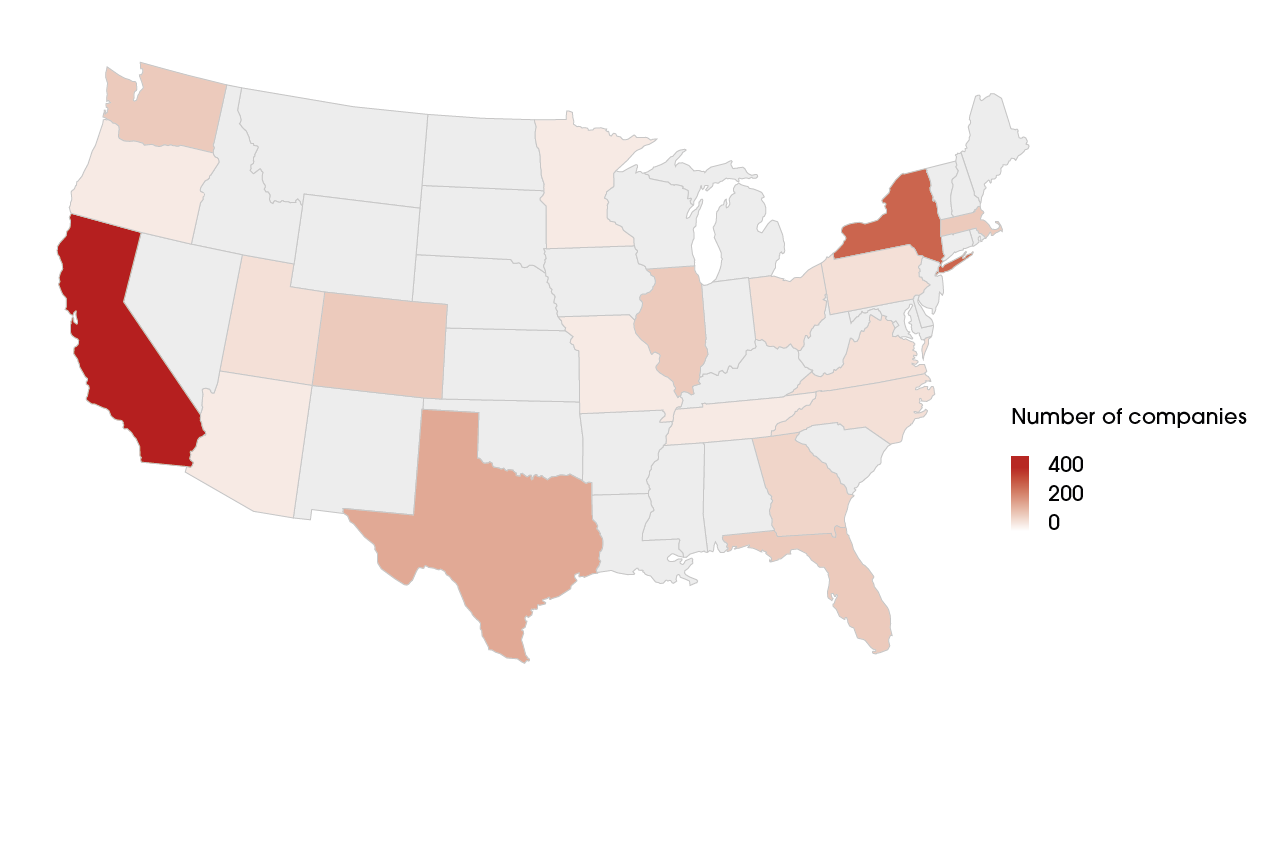

In Texas, many major cities (El Paso, Dallas, Houston, Ft. Worth, College Station) have high tax rates, which drive up valuations, but the state itself has very low tax rates in an attempt to attract businesses to the state. In Washington, Seattle is a secondary tech-hub, comparable to Silicon Valley. In Massachusetts, the market is driven by Boston, a location of “old money” – by American standards – where luxury housing drives much of the market, as in New York City. Similarly, in Illinois, the major economic center of Chicago attracts much of the business of the real estate market. The drop in California’s share of the market (from 38% down to 36%) reflects the overall growth of these other areas, in the case of Texas and Washington, as well as the diffusion of PropTech into more traditional real estate markets, in the case of Illinois, Massachusetts, and New York.

While it is not a surprise that the distribution mirrors the distribution of technology companies in the United States, it is notable that Silicon Valley seems to be on the decline as a proportion of the market share. However, we have not yet seen the growth of unexpected new market centers. Instead, technological innovation in real-estate seems to be creeping into and influencing some of the more traditional – and previously slower to change – real estate markets of Boston, New York City, and Chicago.

Boston, New York, Chicago, Seattle, Houston, Dallas, and Silicon Valley have several features in common: They all have a high-density of highly educated potential real estate investors. They also feature some of the world’s leading research universities nearby and have been centers for young businesspeople to flock to seeking opportunities for decades. Thus, they are considered safe bets for potential start-ups in the PropTech sector. We might combine these factors to underscore factors that PropTech startups should look for when seeking a potential market: a robust supply of well-educated labor, potential investors, steady markets with strong guarantees of returns, and environs that are generally conducive to business. However, the question becomes will these innovation hubs also become increasingly decentered following the trends of the Real Estate industry in the United States as a whole. Being a PropTech disruptor for industry leaders could mean throwing caution into the wind and seeking out establishing physical offices in areas that are not where business has been traditionally conducted.