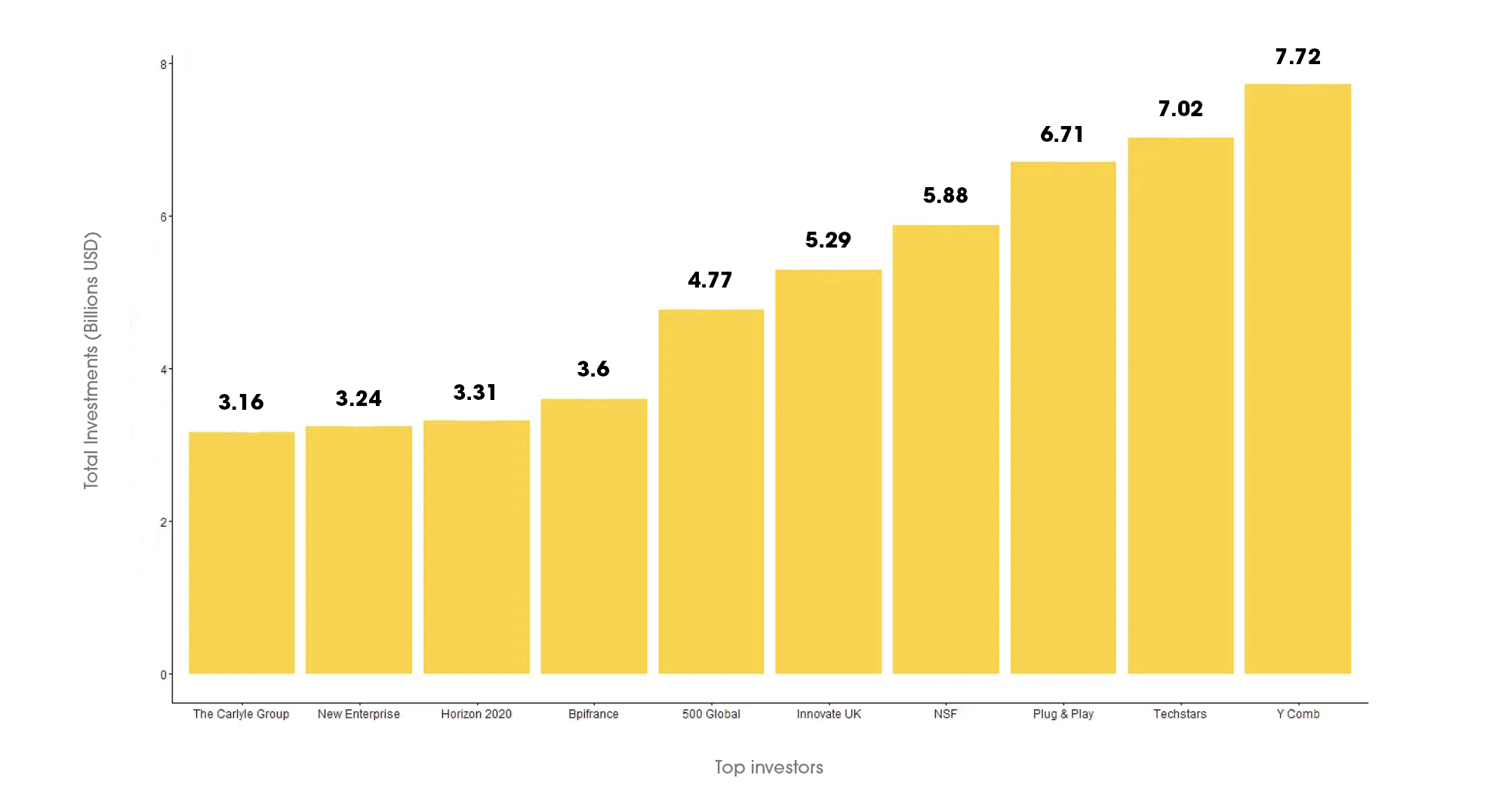

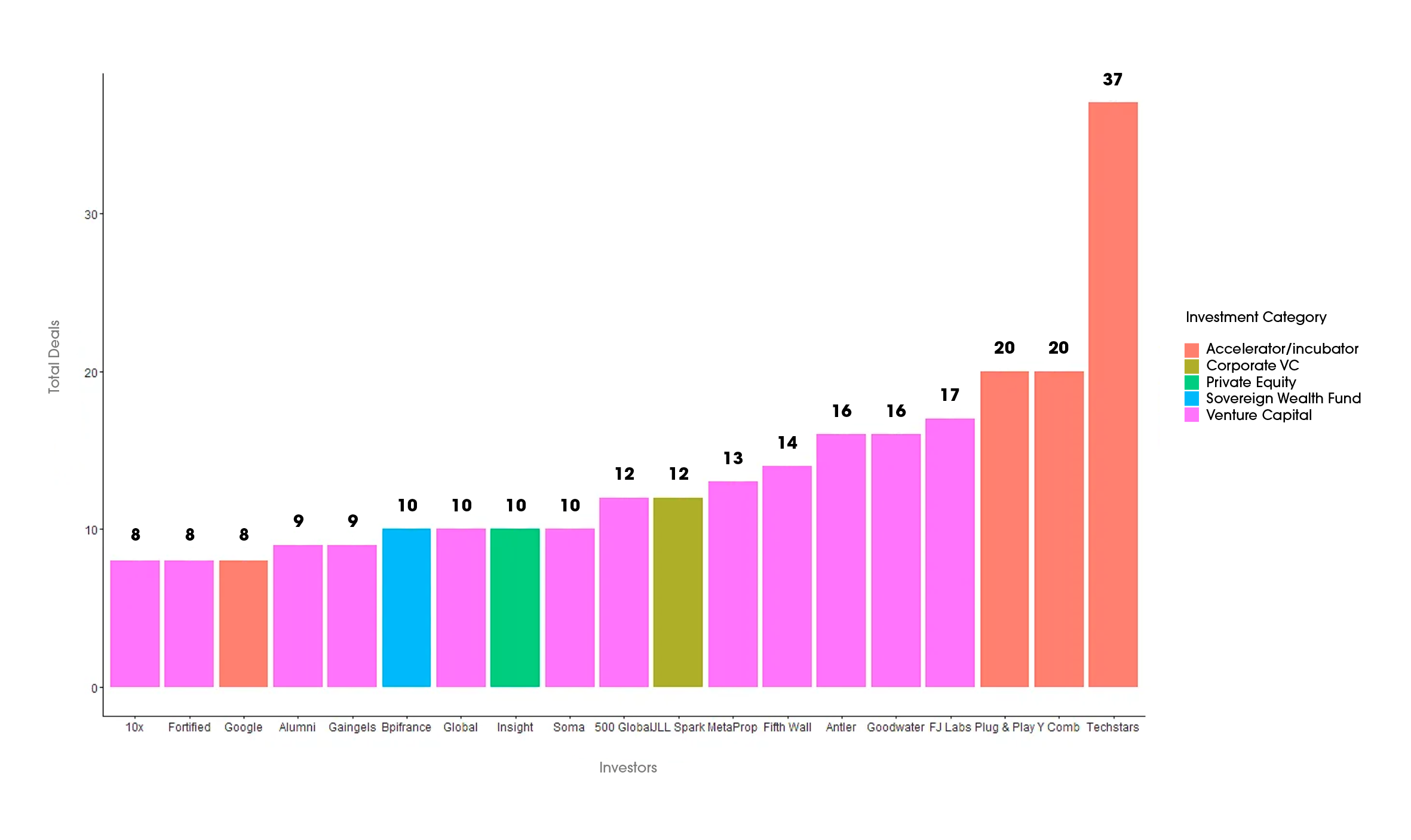

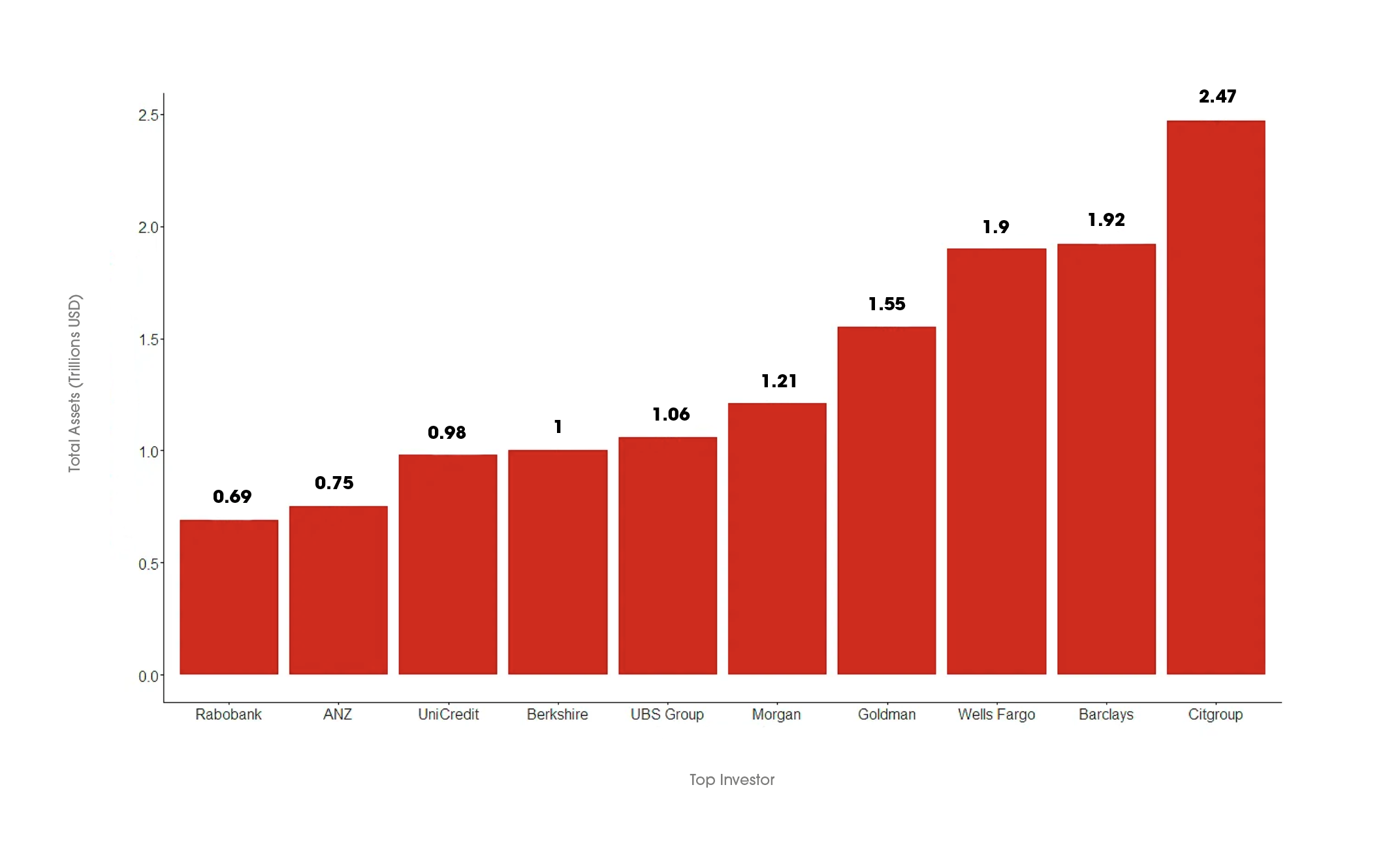

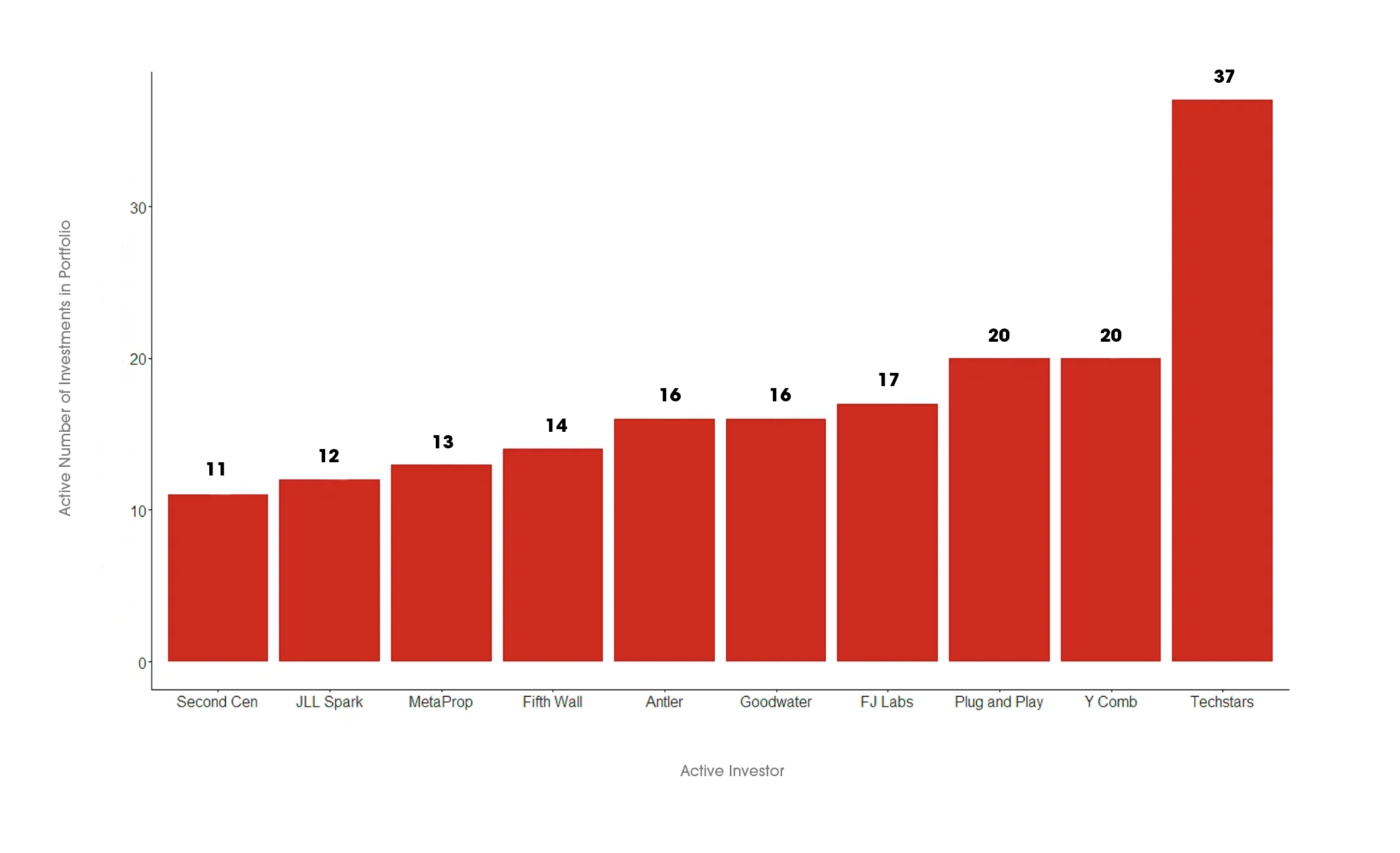

If we rank the top investors who participated in deals in the past year by the total number of their investments over the lifetime of their firm as of 2022-2023, we have an informative picture of the top players of the PropTech industry. Unsurprisingly, because of their long term position and access to capital, government funded ventures through the National Science Foundation in the United States, Innovate UK, and Horizon 2020 SME Instrument in the European Union are on the list of the top ten investors in terms of their total number of investments over time. However, most of these groups have not been very active in the past 12 months. Horizon 2020 SME instrument is mostly no longer active, having participated in just one deal in the past 12 months, while Innovate UK and the NSF participated in just five and three deals respectively. The other top ten players represent a mix of PE/Buyout (Enterprise Ireland), Sovereign Wealth Fund (Bpifrance), and Venture Capital (New Enterprise Associates and 500 Global). Bpifrance and 500 Global ranked in the top twenty most active investors this past year but just missed out on the top ten. Nevertheless, the cream of the crop remains three accelerator/incubator firms, Y Combinator, Techstars, and Plug and Play Tech Center, all three of which are also on the top ten list for most active investors this past year, along with the top ten investors for the year in terms of total investments. In other words, the most active investors are those that specialize as either accelerators or incubators.

- Accueil

- Évaluer sa maturité numérique

- Plus de 100 Professionnels du Numérique pour vous accompagner.

- Programme de sensibilisation

- FlashUP – Tool Box

- Financer son projet

- Tout savoir sur le programme EME !

- Comprendre le numérique

- PropTech Global Trends 2024

- Référencement Annuaire Professionnels du Numérique

- Guide du E-Commerce

- Témoignages EME

- F.A.Q.

- Contact