Among the top all time PropTech fundraisers still quite active in the 2022-2023 cycle, Reef Technology is particularly important. The company is working to help transform urban landscapes, through adopting unused urban spaces to current needs. Consider the example of parking lots. These physical spaces create massive urban heat islands and often go at least partially, if not mostly unused. They are essentially single-use spaces. However, they can be transformed into multi-use places through integration with technology that connects restaurants, airports, hotels, warehouses, and more to popular brands. Each of these businesses would gain value through the interaction, while the investor in the formerly-single-use parking lot also increases their revenue stream. They additionally install “Food Hall” panels, which are quick-service interaction panels for customers in high-traffic areas, such as university campuses, urban mega-malls and shopping centers, sports stadiums, airports, and more.

While Reef Technology focuses on the fundamental transformation of public urban and commercial spaces, Generation Home is providing new technological solutions for the process of mortgage lending in England and Wales, where they utilize a combination of cutting edge UI and data management software to facilitate the entire experience of home purchasing, from formulating a budget, through the mortgage application and approval process, conveyancing, remortgaging, moving, and more. Their “Income Booster” interface allows clients to easily add family members (parents, grandparents, siblings, aunts, or uncles) who are helping to purchase a home through gifts, which will help the applicant borrow more, although the “Income oster” will not live in the home. Typically, this process includes letters, signatures, and forms which all must be completed in-person or sent via e-mail, in a fashion where the data stored is not particularly secure.

Importantly, in the case of Reef Technology’s lending models, the “Income Booster” is also distinct from the “Deposit Booster” – an unlimited number of friends or family who can contribute toward the deposit and downpayment of a home. Here, a “Deposit Booster” is different from an “Income Booster” in that the pot of money is structured so the individual(s) contributing toward the deposit will get a small amount of their initial contribution back later, while also allowing for parents to support more than one child with the same pot of money. Finally, “Dynamic Ownership” allows for co-investment with up to five (5) other parties, allowing each individual to build equity in a property. Here, Generation Home’s technological contribution is through creating software that allows clients to easily track contributions and share of the home over time.

At the intersection of PropTech and FinTech, Figure (Financial Software) is a private company founded in 2018 by Mike Cagney ( who also founded SoFi), with some 53 investors and just over five hundred employees. Based in San Francisco, the company is transforming the trillion-dollar financial services industry by exhibiting the latest in combining the technologies of blockchain, artificial intelligence, and advanced analytics to facilitate the management of digital assets. Figure’s platform specializes in home equity release services, including home equity lines of credit, home improvement loans, and home-buy-lease back offerings for retirement. Additionally, Figure also offers business solutions through their platform “Figure Pay” which is a Banking as a Service (BaaS) API-based platform, also built on blockchain rails, or networks of how payments move from payers to payees, offering extremely secure transactions.

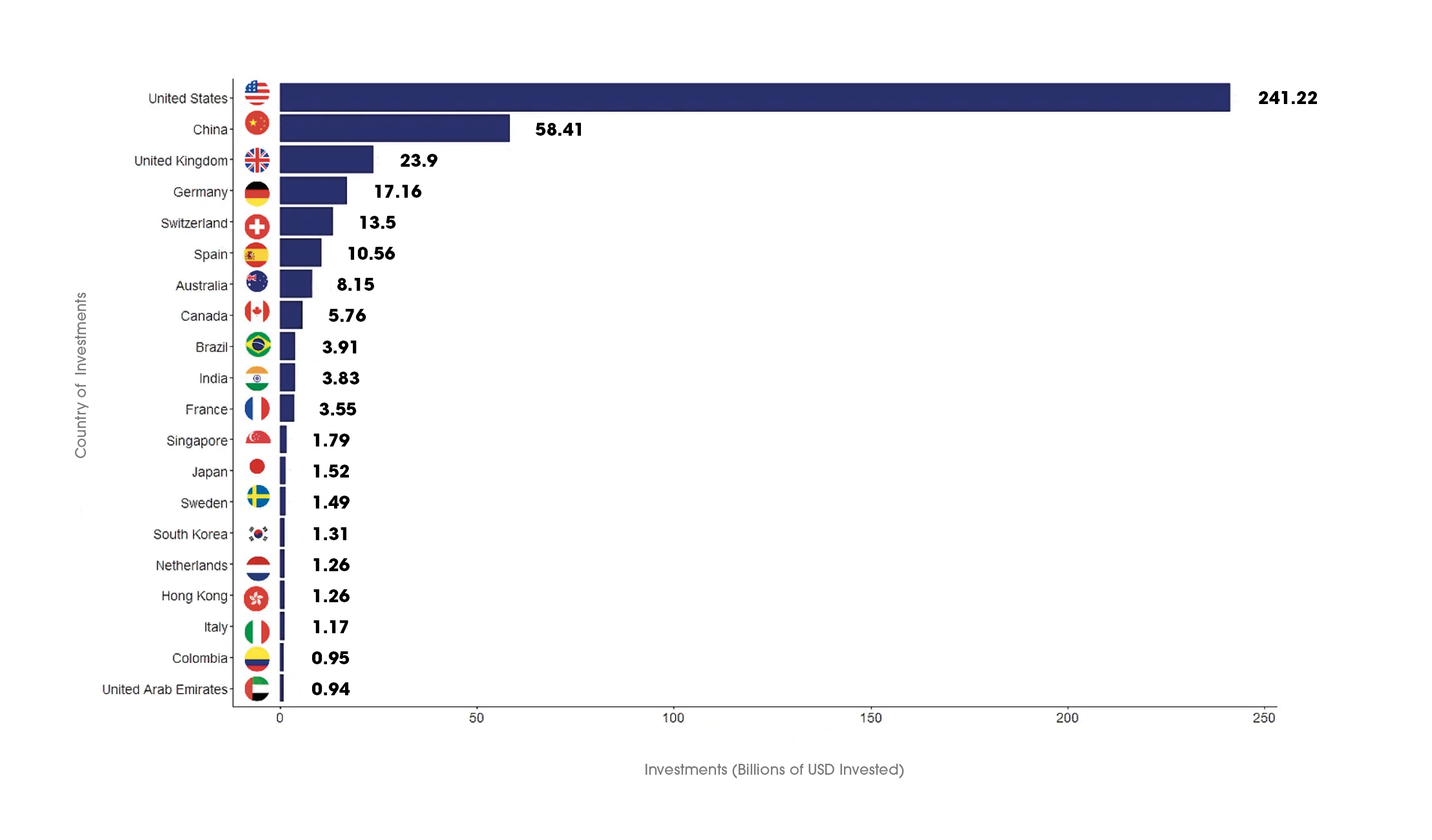

While Reef Technology, Generation Home, and Figure all emphasize the intersections between B2B and B2C interactions, JD Property is a major Chinese innovator in infrastructure and B2B interactions, with eight significant investors, including BlackRock and GIC (a Singapore-based Sovereign Wealth Fund). JD Property aims to create intelligent industrial parks and energy systems through merging solutions from renewable energy and smart technology. By doing so, they enable their clientele with the ability to create sustainable and efficient production environments. While the technologies they utilize might not be adoptable to economies of countries with less emphasis on manufacturing and production, it is still important to remember that these environments are another area where PropTech is providing vital solutions to today’s most pressing challenges.