The stories of Matterport and Alice Technologies are certainly remarkable. Both companies have fundamentally transformed the future of the real estate industry. At first, Matterport made headway by digitizing records of existing buildings, paving the way, in a sense, for Alice Technologies to build upon their shoulders, and delve in the realm of simulation. Through simulating construction, companies can now lessen their carbon footprint, create more sustainable, safer, and longer lasting structures, speed up the pace of construction and reduce rework.

Overall, Construction Technology is the field that deals most directly with physical assets, while also interacting most intimately with the web of regulations that can ensnare any project. Furthermore, although we will deal with Climate Tech distinctly in Case Study 4, it is important to note that Construction Technology is on the forefront of addressing the many problems associated with the realities of Climate change. From the use of more sustainable construction materials, including the safe reuse and repurposing of formerly toxic materials, through energy saving technologies like smart glass, the Construction Technology subfield of PropTech is working to address these pressing problems as well.

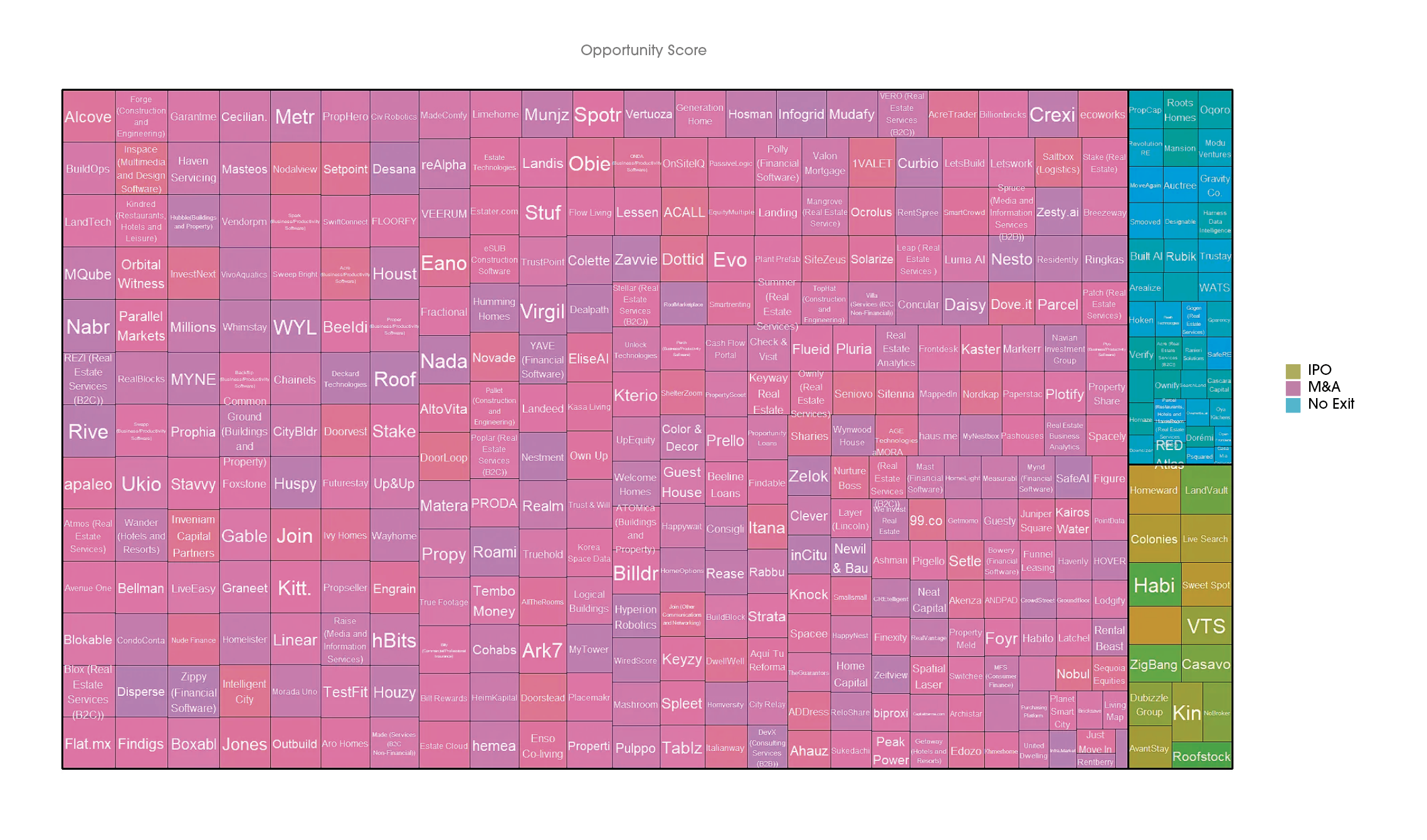

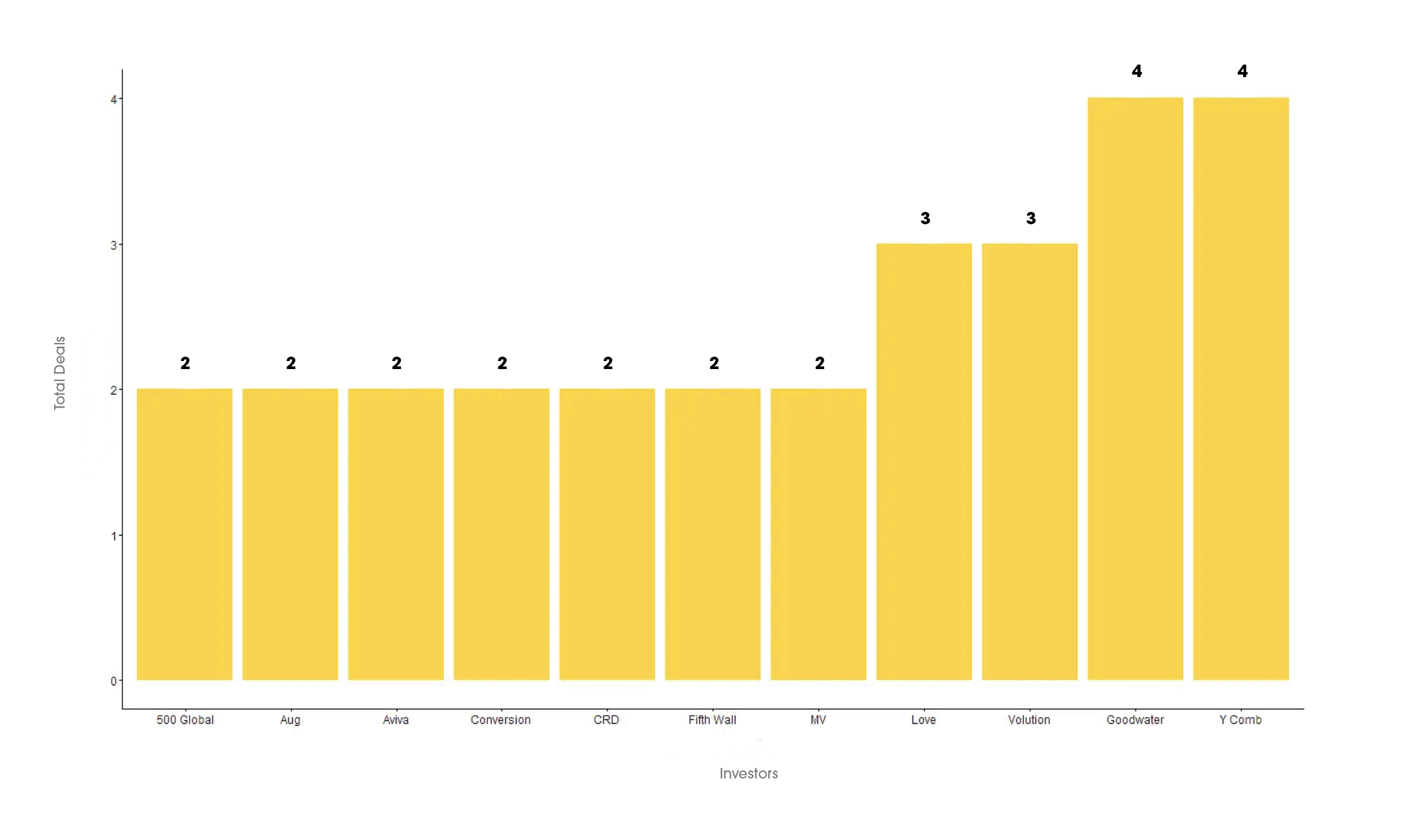

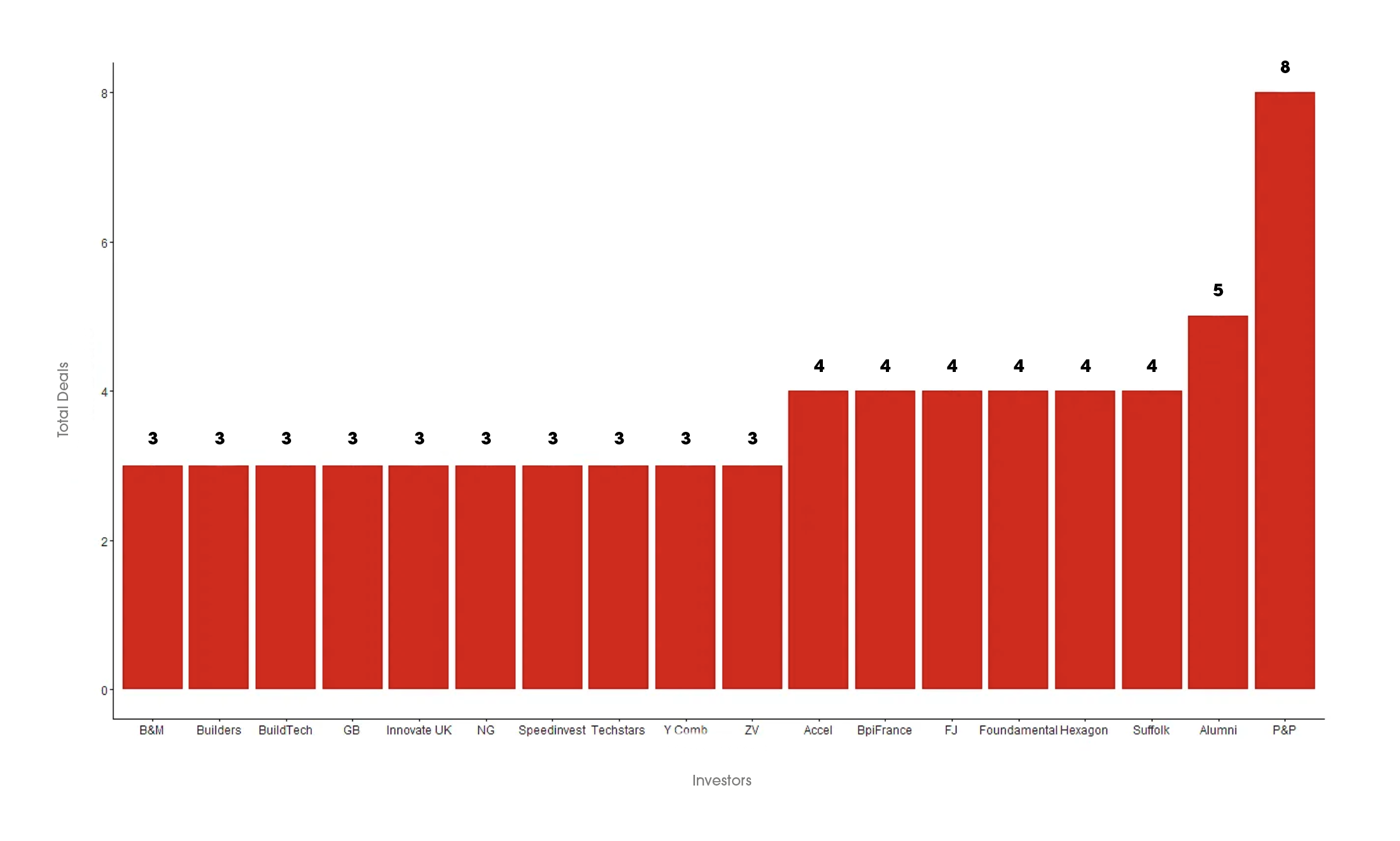

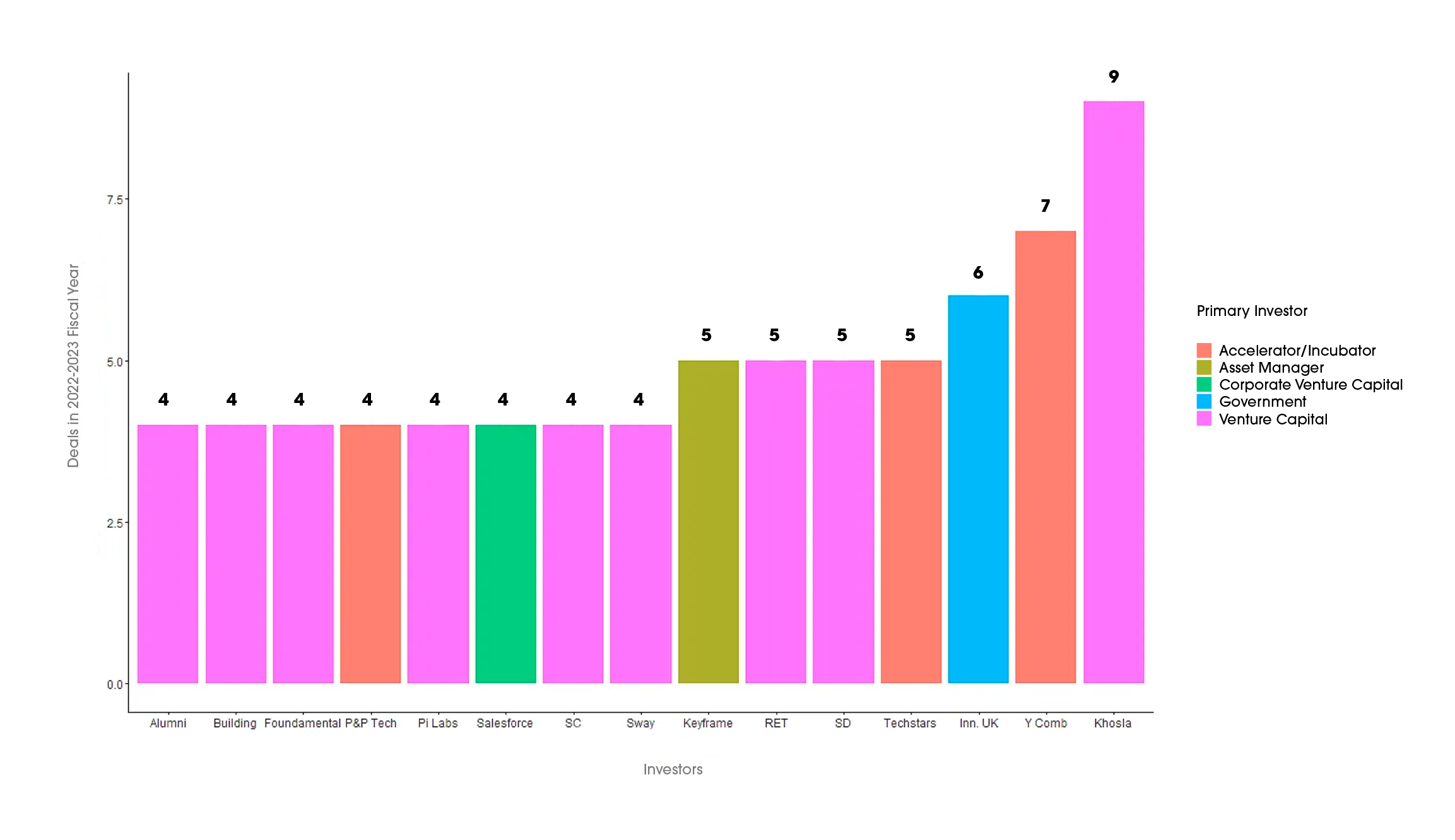

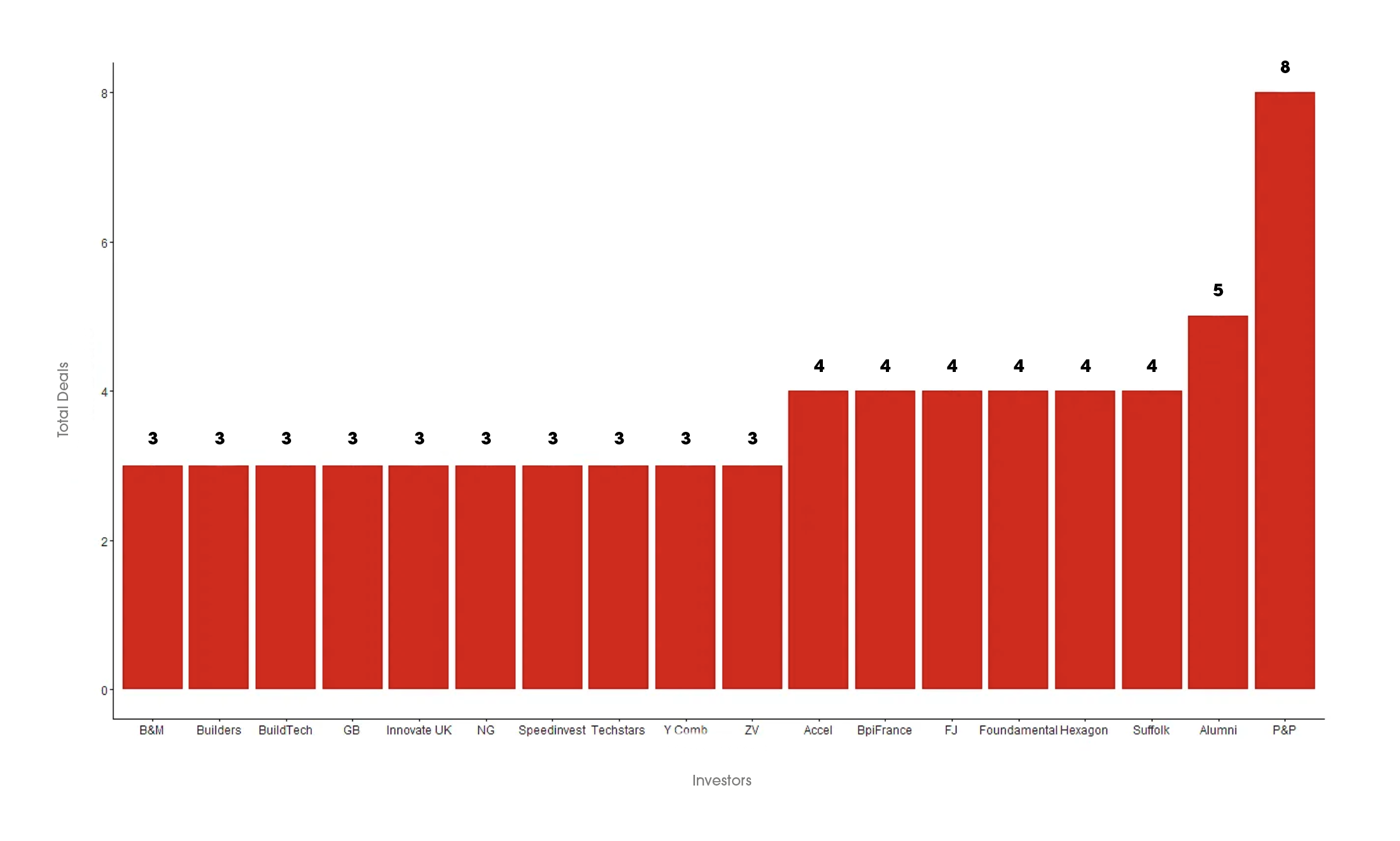

Figure 43: Construction Tech Investors

Figure 43 shows the most active investors in the Construction Technology field in the past year. Notably, we see that investors are more active in the Construction Technology space at present when compared to the Mortgage Technology space. This difference may reflect the greater opportunities for technological innovation present in the Construction Technology field. Most active investors are, naturally, large venture capital firms just as Alumni Ventures (Manchester, NH) and Accel (Palo Alto, CA). However, they also feature the major accelerator/incubator companies, such as Plug and Play Technologies and Techstars. Furthermore, they also include sovereign wealth funds like Bpifrance and government investors like Innovate UK. Of these investments, 61.03% are based in the United States, while 8.59% are located in the U.K. and just 8.14% are located in the People’s Republic of China (PRC). Relative to overall investments in PropTech, this means that a lower proportion of Construction Technology investments are in the PRC in the past year, which runs counter to expectations. Additionally, while 154 French investors made up a substantial proportion of the market, in that they account for 5.69% of the capital raised, significant overall players in PropTech, such as German and Spanish investors, haven’t been as active in Construction Technology, suggesting there is space for growth in those markets in such countries.

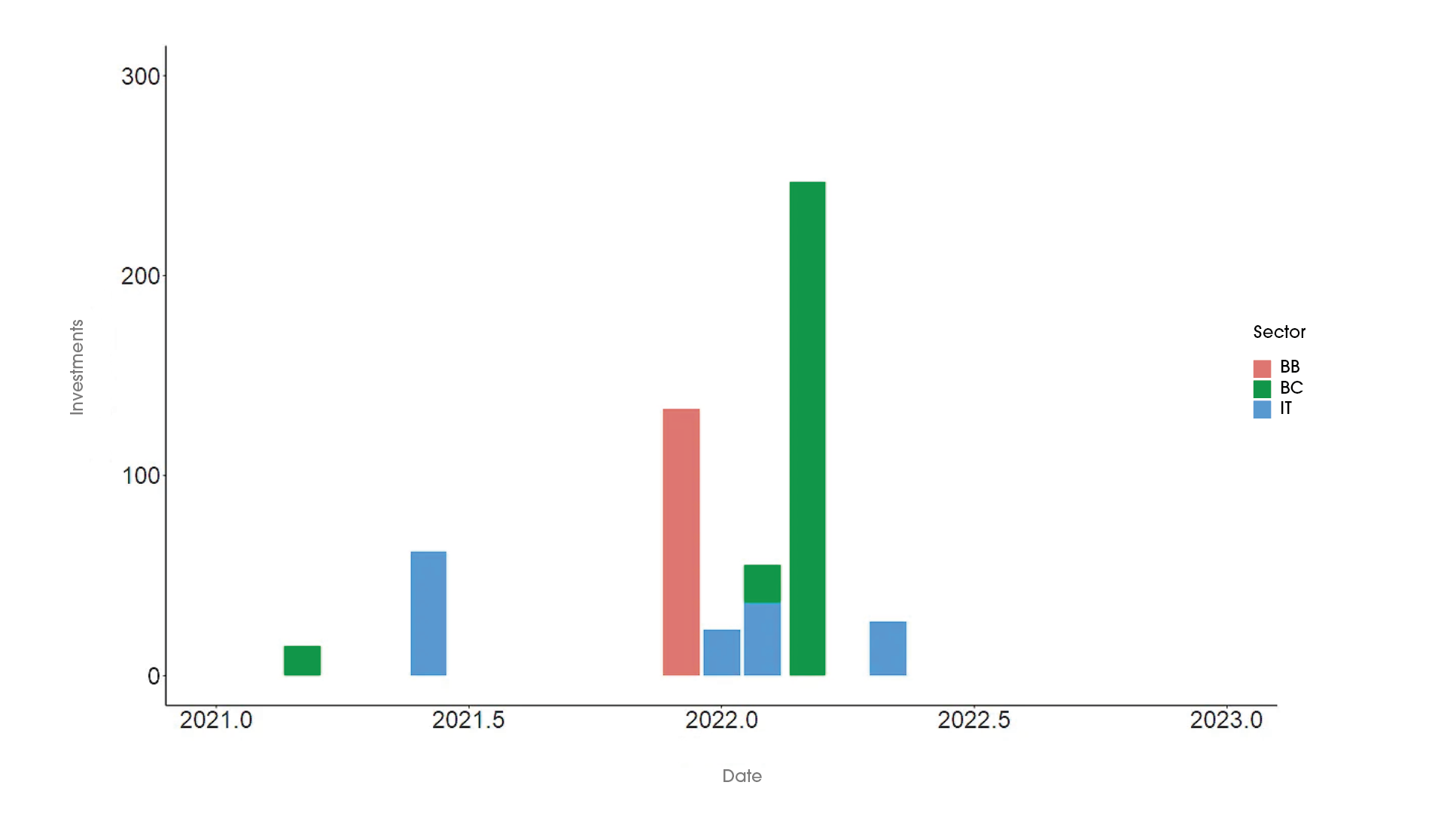

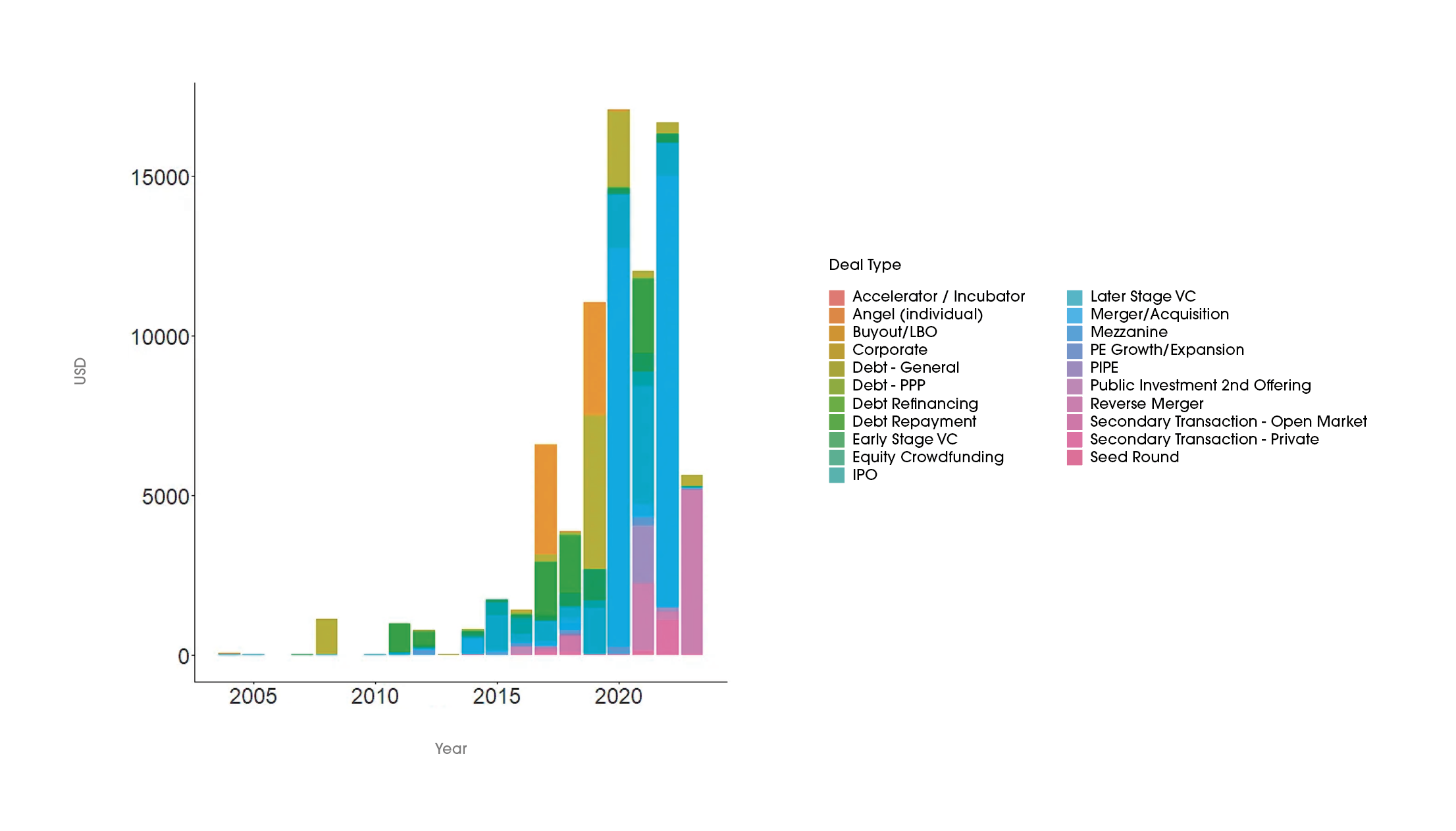

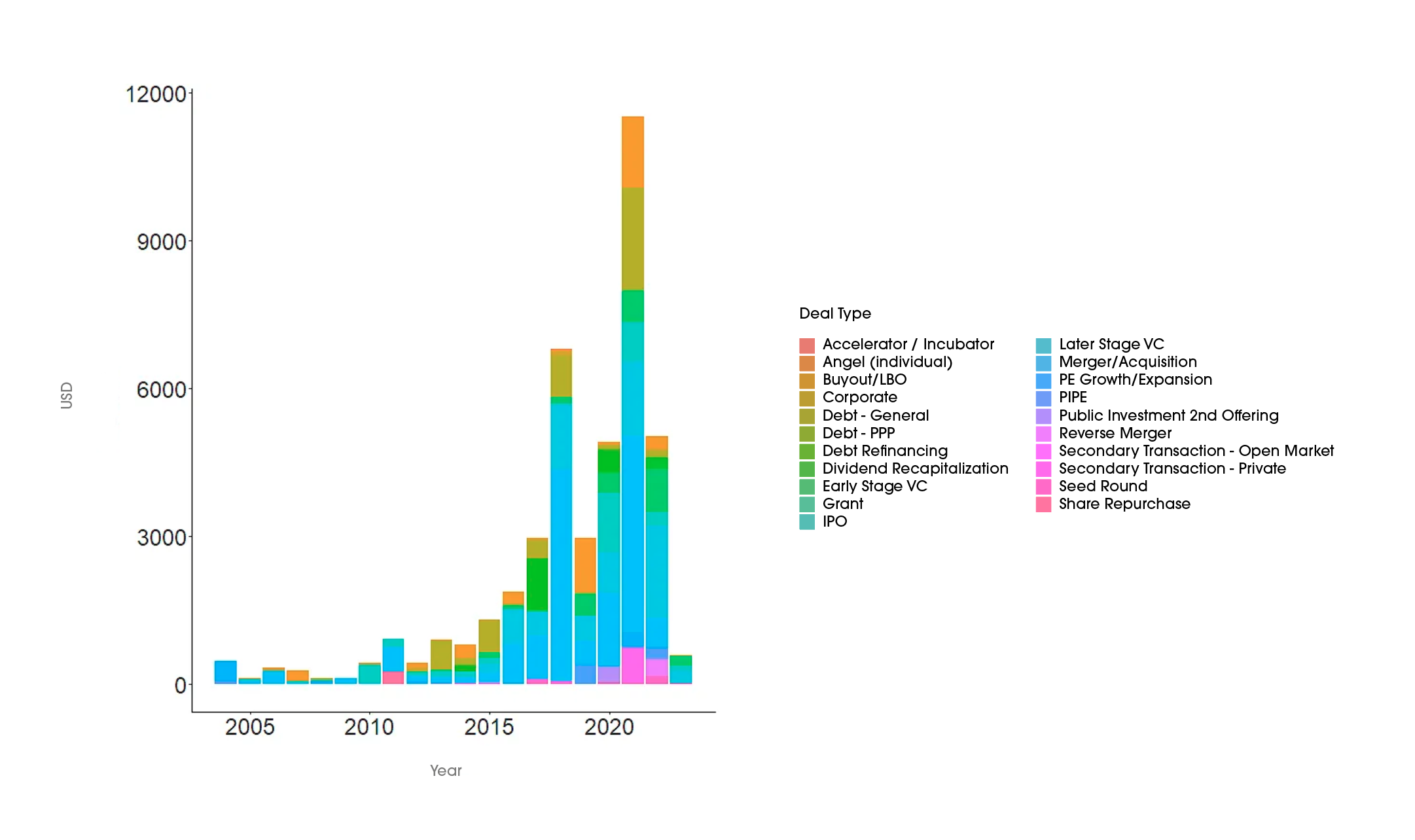

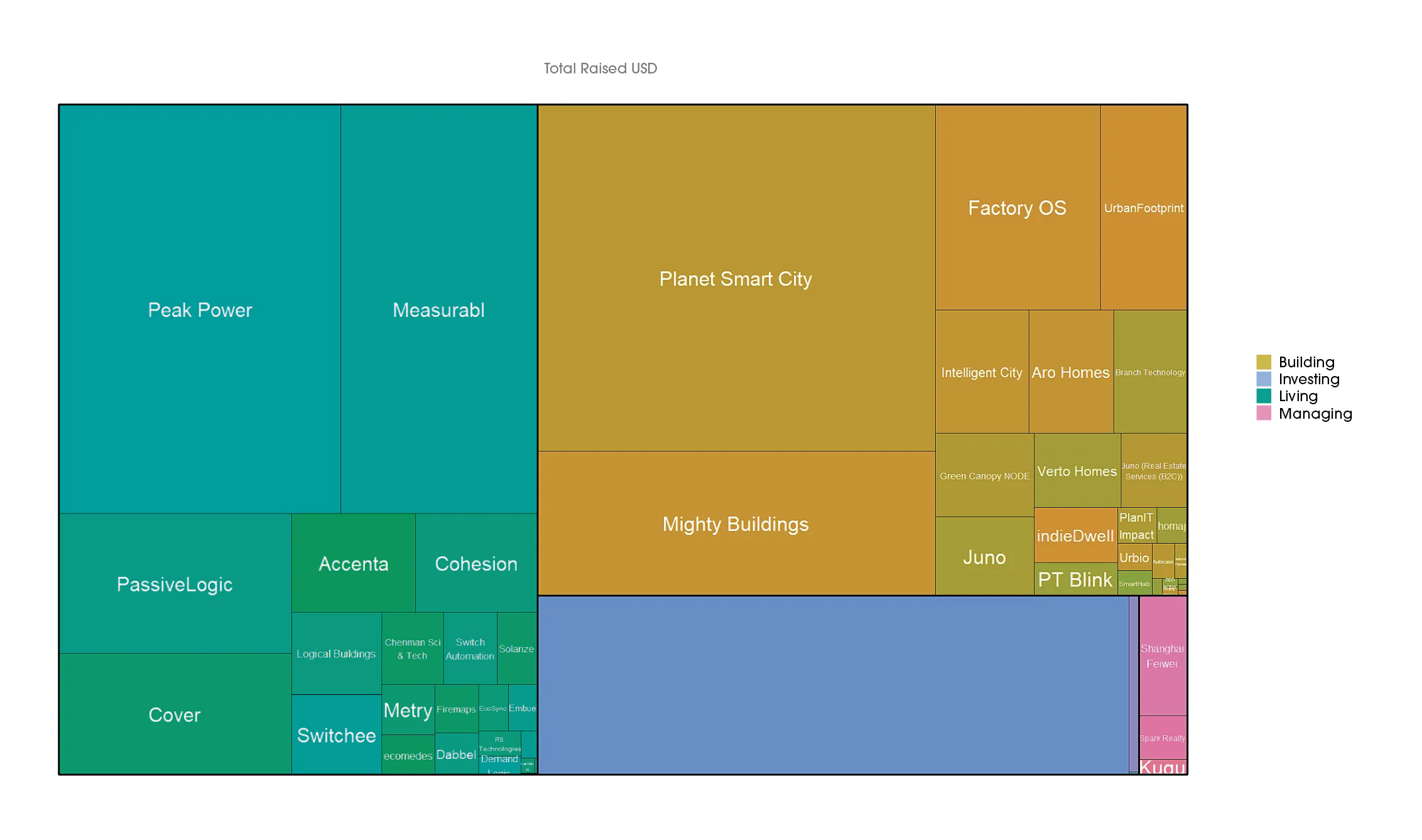

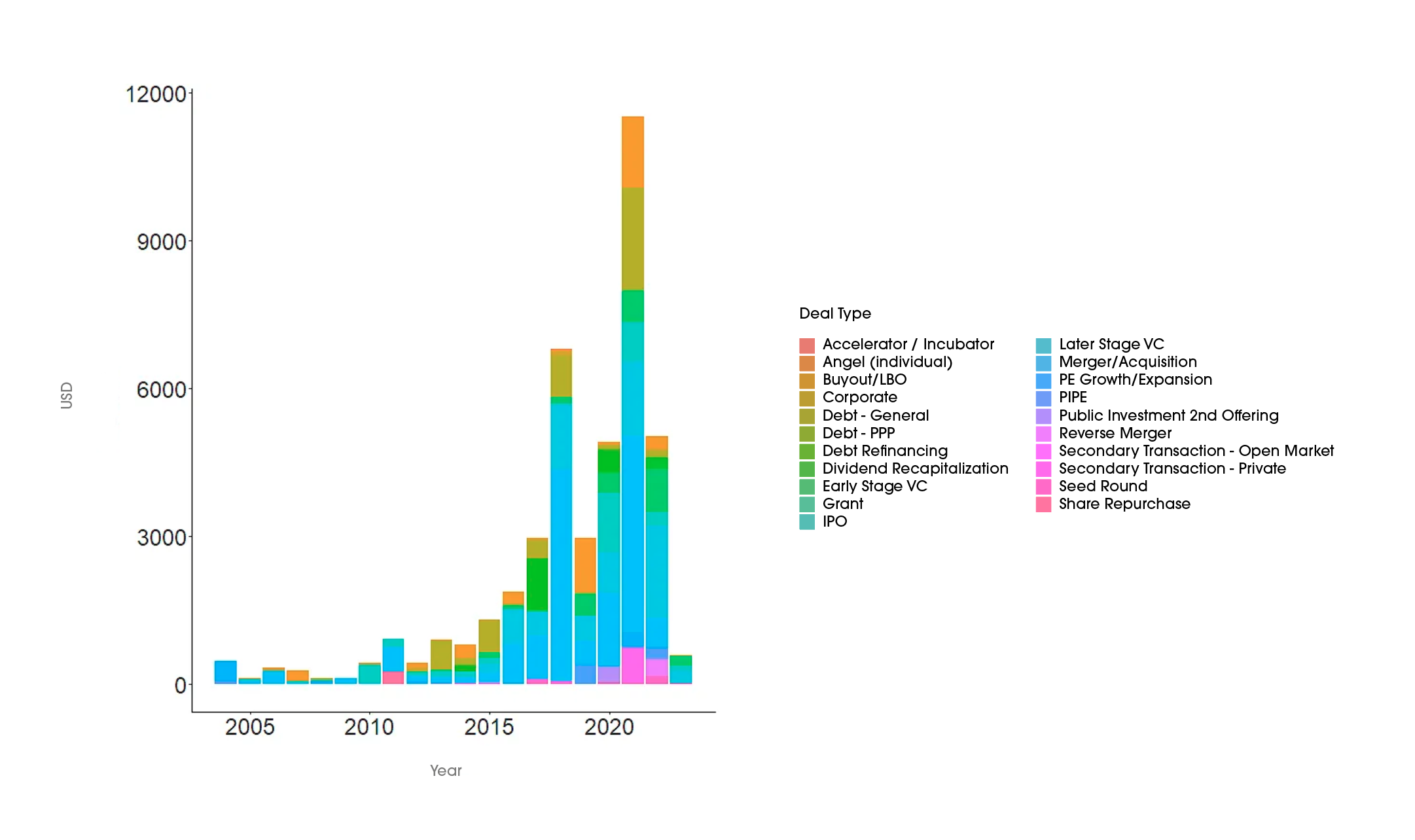

Figure 44: Construction Tech Deals by Size, Type, and Year

Figure 44 is an illustration of the key deals by size, type, and year in the Construction Technology space. We can note that while there is substantial growth of Mergers & Acquisitions in the 2021 calendar year, following a similar pattern in the Mortgage Technology space, the sudden spike in M&A does not appear to be as anomalous in the Construction Technology space. For instance, a quite substantial number of large M&A deals were completed in 2018, well before “Pandemic Economics” was a significant disruptive force in its own right. Further, when we break these deals down by country, as illustrated in Figure 46 (below) we see some interesting points that emerge.