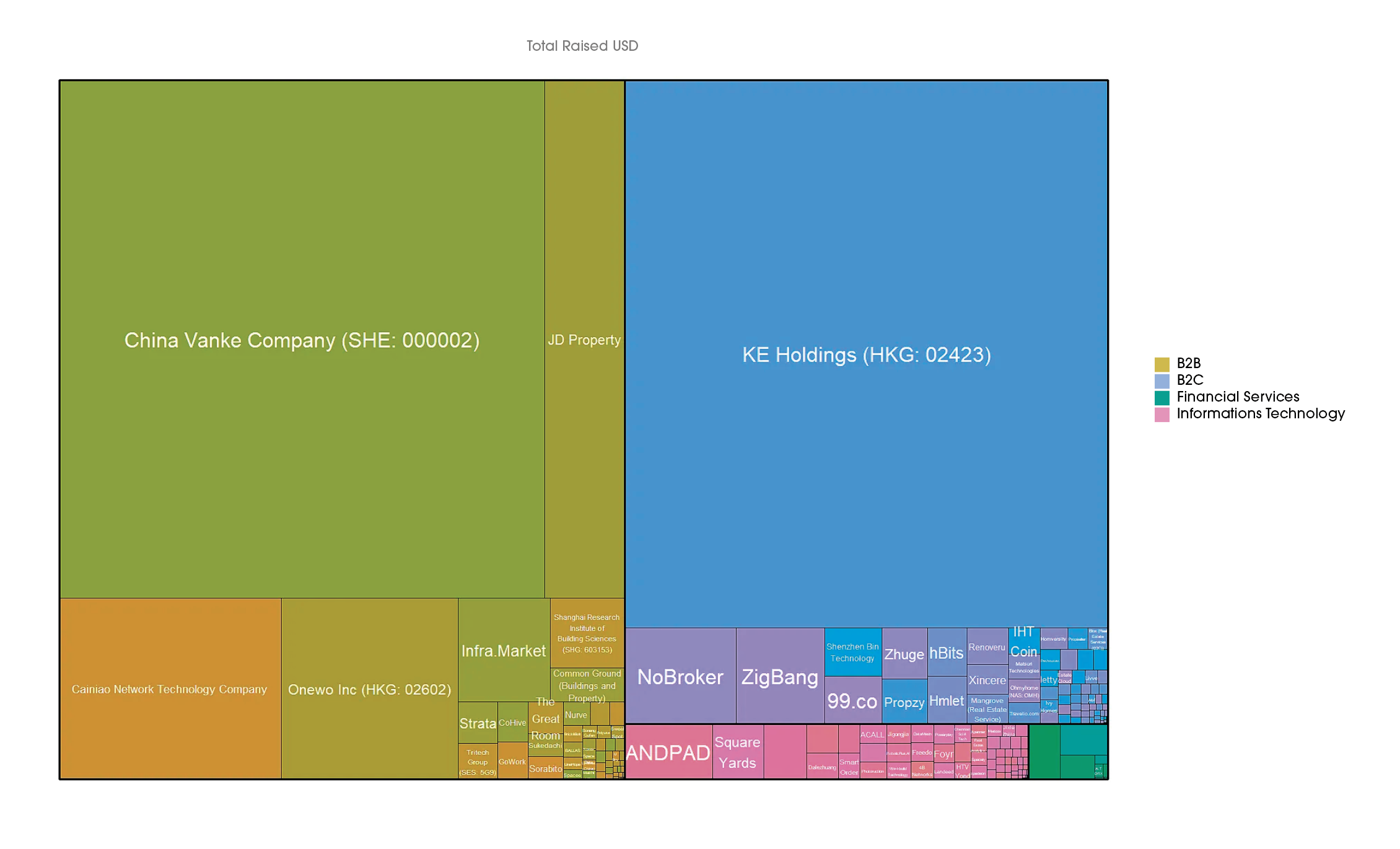

Among the top American companies active in the past year, we see some familiar players rise to the top when we rank them by total finances raised. Lineage Logistics is by far the top company, with more than $10.2 Billion USD raised. Then Corporation Services Company comes in second with $4.85 Billion, quickly followed by MRI Software, a provider of real estate and investment management software to owners, investors, and operators, based out of Solon, outside of Cleveland, Ohio came in third, with just over $4 Billion USD raised to date. While their work includes automation in the areas of financial operations, they also complete strategic planning projects, operate in commercial management, and work in compliance management for affordable housing, public housing, voucher management, waitlist management, and asset management. Additionally, in June 2023, MRI Software Launched a commercial tenant porthole, which allows for easy access to billing, payments, and online service requests. In the second tier of companies, we have Reef Technologies, Figure Financial Software, Insurity, and Better, all of which raised between $1 and $2 Billion USD. In a third tier, we find OfferPad, Homelight, Knock, Ribbon, Setpoint, Plum, Kiavi, and Homeward, having raised between $500 million and $1 Billion USD all time. Finally, a fourth tier rounds out the top twenty companies by all-time fundraising totals, with Roofstock, Deliverr, EasyKnock, TS, and Pacaso all having raised between $400 and $500 Million USD. A significant portion of these companies are in our Financial Services Category. Notably, MRI Software, Better, Figure, Insurity, Plum, Kiavi, and Easy knock are all operating at the intersection between PropTech and FinTech.