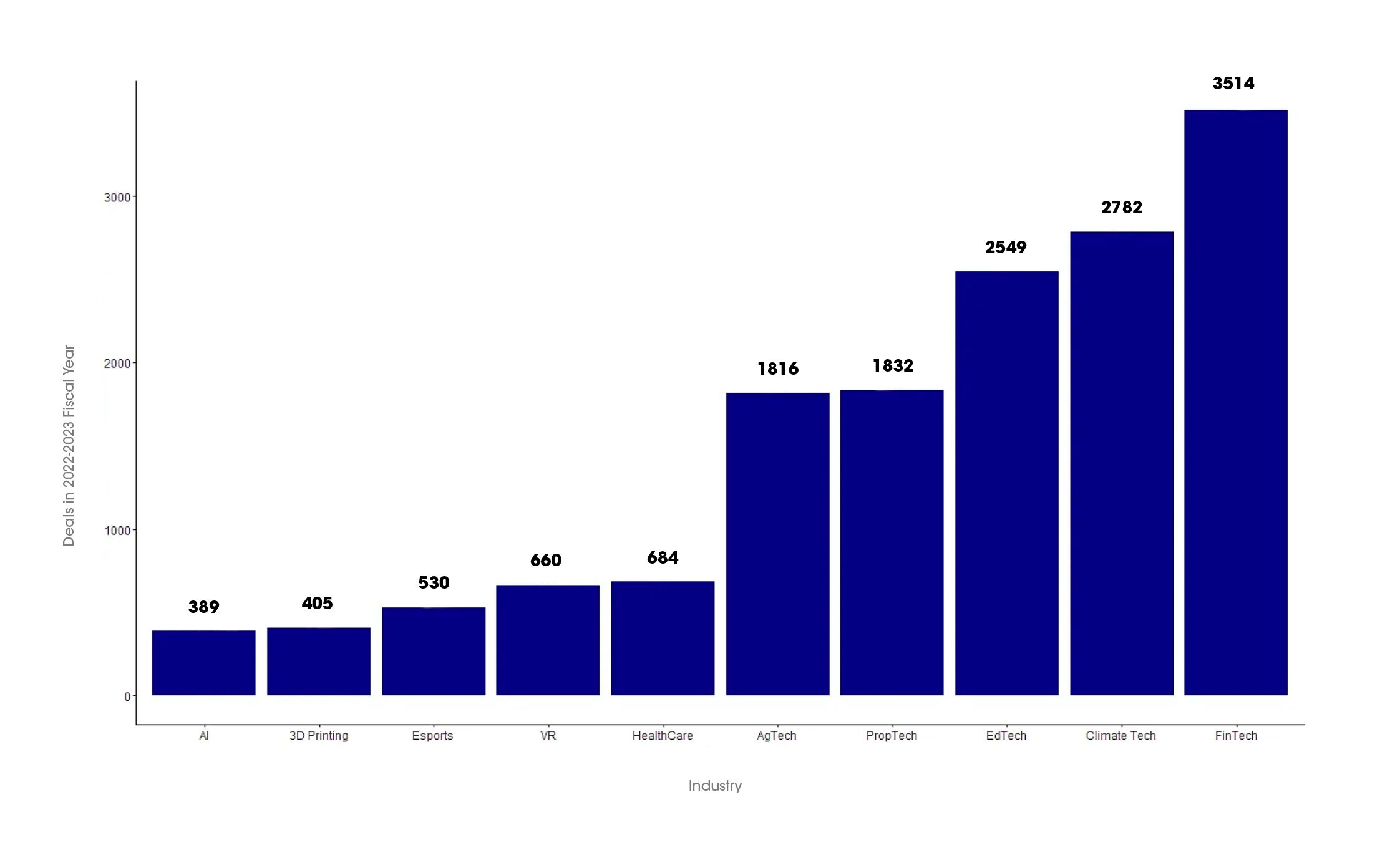

Figure 33 examines several competing industries by deal count for the 2022 to 2023 fiscal cycle, with an emphasis on those most closely comparable to the PropTech market. In this figure, no categories overlap. Our data sorts companies by primary industry and then aggregates the totals number of deals by industry.

Overall, the most active industries, naturally, are AI & Machine learning (with over 11 thousand deals) and SaaS (with over 8 thousand deals), along with E-Commerce and HealthTech (With over 6 thousand deals each). PropTech is safely comparable to industries like Digital Health, Cybersecurity, Robotics and Drones, AgTech, and Mobility Tech in its relative activity. In the past year, PropTech has closely matched AgTech in terms of number of deals completed. Each of these industries has completed around 1 thousand five hundred to 2 thousand deals in the past fiscal cycle. We see PropTech is far above markets like Healthcare Tech, VR, ESports, ED Printing, and AI.

At the same time, we see the marketplace is slightly less active than EdTech, Climate Tech, and FinTech during the past fiscal cycle. These numbers, in part, signal a changing landscape for technology investments in the past 20 years.